Have you ever stumbled upon a drawer overflowing with receipts and invoices, each a testament to past transactions? While these pieces of paper may seem like mere remnants of daily life, they are actually valuable documents holding immense significance in the eyes of the Bureau of Internal Revenue (BIR). This article delves into the world of unused receipts and invoices, exploring their importance, proper management, and the invaluable BIR sample to help you navigate this crucial aspect of your business.

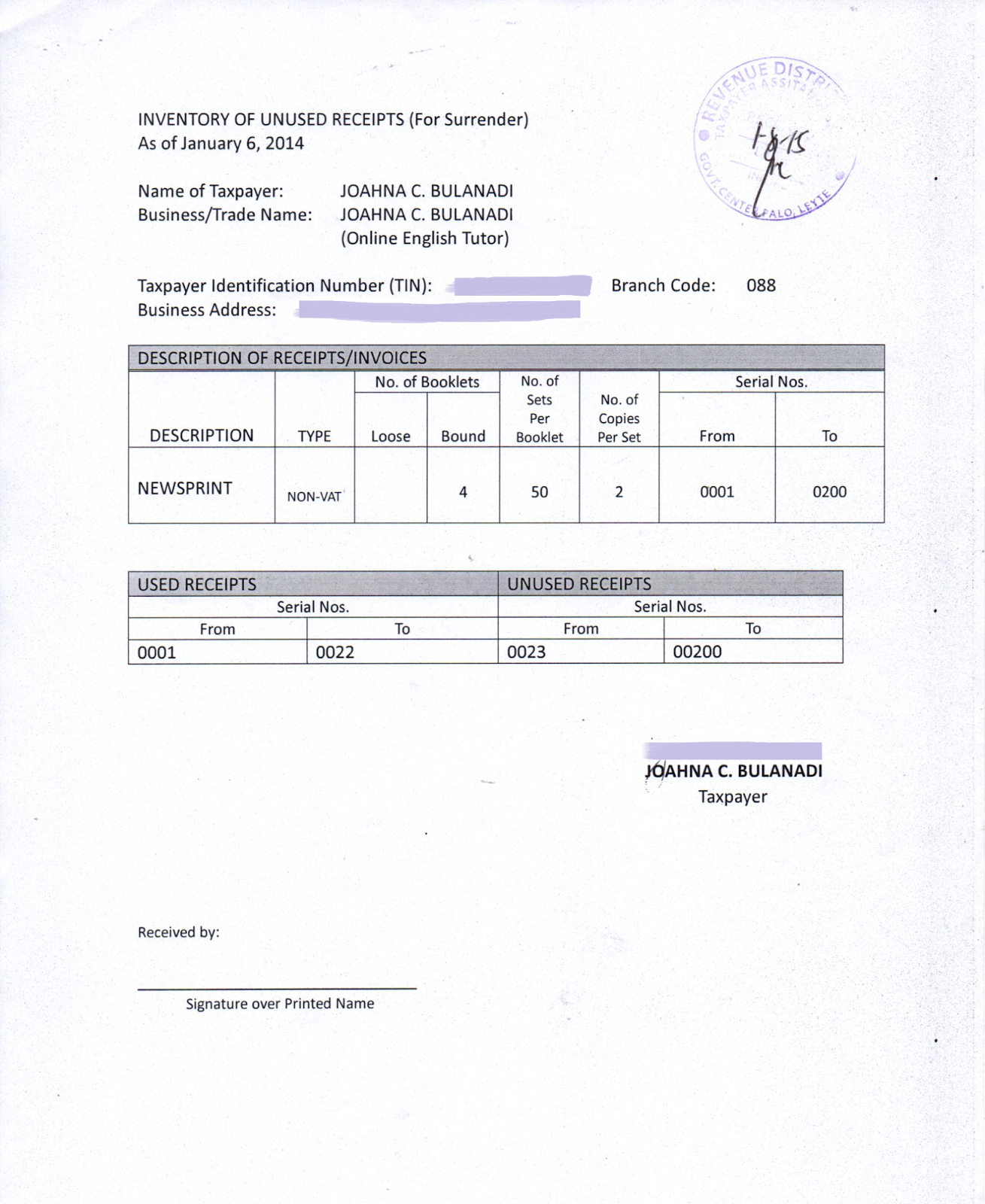

Image: joahnacheska.blogspot.com

Understanding the importance of unused receipts and invoices is not just about keeping track of your purchases; it’s about ensuring compliance with tax regulations and safeguarding your business’s financial integrity. Properly managing these documents can save you from potential penalties, disputes, and financial headaches. Whether you are a seasoned entrepreneur or just starting out, comprehending the nuances of unused invoices and receipts, especially within the context of BIR guidelines, is essential for your business’s success.

The Crucial Role of Unused Receipts and Invoices: A Foundation for Tax Compliance

Understanding the Basics: Receipts and Invoices

Before diving into the complexities of unused receipts and invoices, it’s essential to understand their fundamental differences:

- Receipts are issued by sellers to buyers as proof of purchase. They typically contain basic details like the date, description of goods or services, and the total amount paid.

- Invoices are more detailed documents issued by sellers to buyers for goods or services provided. They include information about the buyer and seller, the date, a description of goods or services, unit prices, quantities, and the total amount due.

The Legal Mandate for Invoices and Receipts: BIR’s Power of Regulation

The BIR plays a vital role in regulating the issuance and use of receipts and invoices in the Philippines. Regulations are established to ensure transparency and accountability in business transactions. The BIR’s mandate extends to both businesses and individuals to comply with these regulations.

Failure to comply can result in fines and penalties. By carefully documenting transactions using receipts and invoices, you not only comply with the BIR regulations but also keep accurate records for your business.

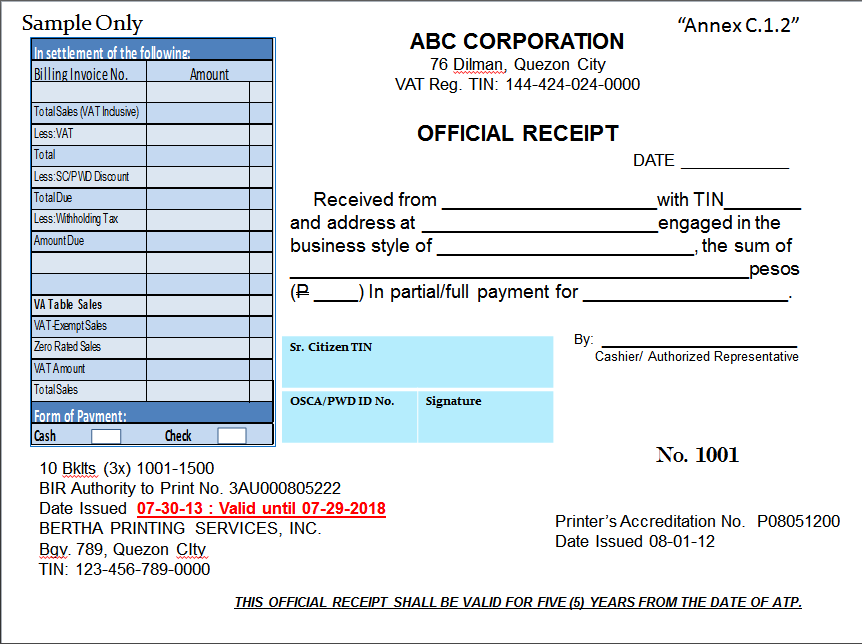

Image: beckybowers.blogspot.com

The Power of Documentation: Beyond Tax Compliance

The benefits of maintaining a meticulous inventory of receipts and invoices extend beyond tax compliance. An organized system helps you:

- Track expenses: Analyze your spending patterns and identify areas for cost savings.

- Manage inventory: Understand stock levels and make informed purchasing decisions.

- Resolve disputes: Provide concrete information for resolving disputes with customers or vendors.

- Claim tax deductions: Ensure you receive all eligible tax deductions based on legitimate expenses.

BIR Sample: Navigating the Labyrinth of Unused Receipts and Invoices

The BIR sample is a crucial resource for understanding the correct format and content of receipts and invoices. It serves as a blueprint to ensure your documents comply with BIR regulations, reducing the risk of errors and potential penalties.

Key Components of a BIR Sample Receipt: Essential Information

The BIR sample receipt, available on the BIR website, outlines the essential details that must be included on your receipt:

- Business Name: Your business’s legal name should be printed clearly.

- TIN: Your Tax Identification Number (TIN) should be prominently displayed, indicating your tax registration with the BIR.

- Date: The date of the transaction is essential for accurate record keeping.

- Transaction Description: A brief description of the goods or services purchased.

- Total Amount: The total amount paid should be clearly indicated.

Key Components of a BIR Sample Invoice: A Detailed Record

The BIR sample invoice, also accessible on the BIR website, outlines the comprehensive information required on an invoice:

- Seller’s Information: Details such as the seller’s name, address, and TIN should be accurately listed.

- Buyer’s Information: The buyer’s complete name, address, and TIN should be included.

- Invoice Date: The date of invoice issuance should be clearly indicated.

- Invoice Number: The invoice number should be unique and assigned sequentially to ensure proper tracking.

- List of Goods or Services: A detailed description of the goods or services provided, including quantities and unit prices.

- Total Amount Due: The total amount due should be clearly stated.

Beyond the Template: Additional Considerations

While the BIR sample provides a starting point, additional considerations are essential for maintaining a comprehensive system:

- Electronic Receipts and Invoices: The BIR has embraced technology. Learn about the benefits and requirements for using electronic receipts and invoices.

- VAT Registration: If you are VAT-registered, your receipts and invoices should clearly depict VAT information.

- Inventory Control: Implementing a system to track unused receipts and invoices, ensuring they are securely stored and available when needed.

Navigating the Complexities: A Guide to Efficient Inventory Management

Maintaining a well-organized inventory of unused receipts and invoices is crucial:

The Importance of Regular Audits: Avoiding Stockouts and Excess

Conducting regular audits of your unused receipts and invoices is a best practice:

- Identify Shortages: Determine if you have sufficient stock to meet future transaction demands.

- Prevent Excess: Avoid unnecessarily printing more receipts or invoices than needed, reducing waste and saving costs.

- Ensure Compliance: Verify that all receipts and invoices are compliant with BIR regulations.

Streamlining Your Inventory: Using a Spreadsheet or Software

Implementing a system for managing unused receipts and invoices is crucial:

- Spreadsheet-Based System: A simple excel spreadsheet can track information such as type, quantity, and date of receipt/invoice.

- Software Solutions: Invest in dedicated business software that incorporates inventory management features for both physical and digital receipts and invoices.

Secure Storage Solutions: Protecting Your Valued Assets

Safeguard your unused receipts and invoices from loss, damage, or unauthorized access:

- Physical Storage: Utilize fireproof cabinets, safes, or other secure storage solutions.

- Digital Storage: Implement cloud-based storage solutions that offer secure access, backups, and version control.

Inventory List Of Unused Receipts And Invoices Bir Sample

Conclusion: Embracing Efficiency and Compliance

The BIR sample is an invaluable resource for businesses in the Philippines. Mastering the use of unused receipts and invoices allows you to maintain accurate financial records, ensure tax compliance, and safeguard your business from financial risks. By embracing a well-organized inventory system and adhering to BIR regulations, you can streamline your operations, simplify tax filings, and build a foundation for your business’s long-term success.

Remember, understanding the intricacies of unused receipts and invoices is an ongoing process. Stay updated on the latest BIR regulations, utilize the available resources, and continuously adapt your inventory management strategies to ensure your business remains compliant, efficient, and financially sound.