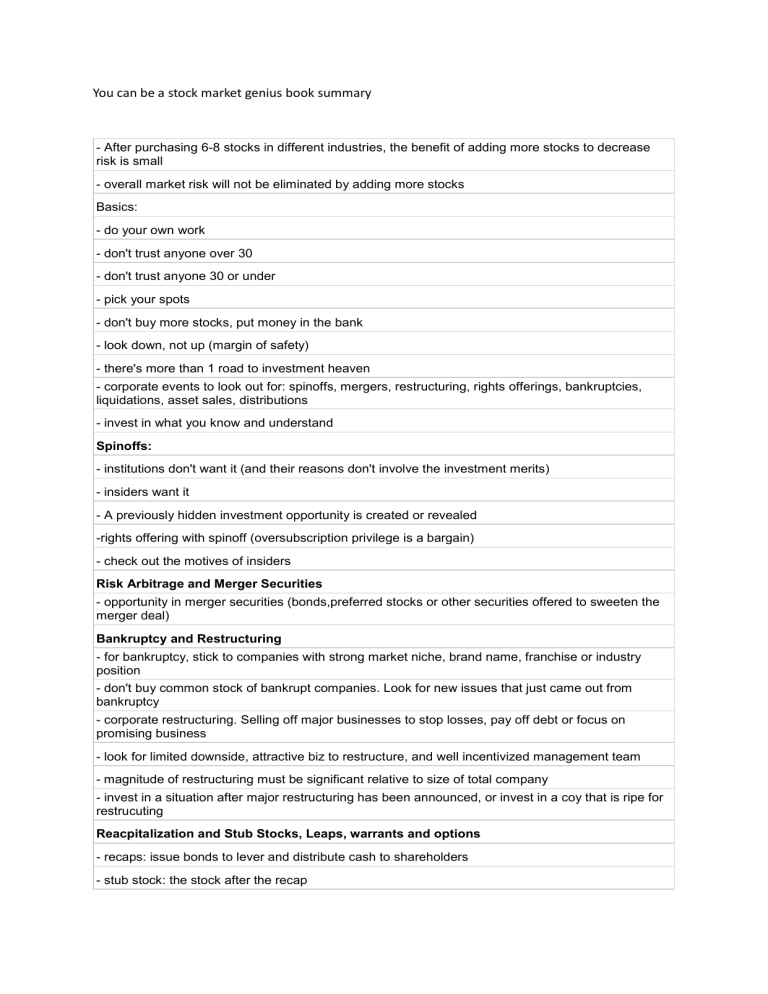

Have you ever dreamt of becoming a stock market maestro, effortlessly navigating the swirling tides of the financial world and reaping the rewards of savvy investment? The idea of turning your hard-earned money into a flourishing portfolio might seem like a distant utopia, but it’s closer than you think. While becoming a stock market genius overnight is a feat of fiction, mastering the fundamentals and developing a strategic mindset is absolutely within your grasp. This comprehensive guide, inspired by the concept of “You Can Be a Stock Market Genius” PDF resources, will equip you with the knowledge and confidence to embark on your journey towards financial success.

Image: www.moneymarket.net.in

The stock market, often viewed as a complex and intimidating labyrinth, is simply a marketplace where buyers and sellers converge to trade ownership of publicly listed companies. By understanding the basic principles governing this market, you can navigate its complexities with a newfound clarity. Whether you’re a seasoned investor or just starting your financial journey, this guide will demystify the market’s intricacies, empowering you to make informed decisions that align with your goals.

Understanding the Foundations: Demystifying the Stock Market

1. The Players and Their Roles:

The stock market is a vibrant ecosystem populated by diverse players, each fulfilling a crucial role. At its core are the companies issuing stocks and the investors purchasing them. These investors can be individuals, institutions like pension funds, or even hedge funds. The stock market is not a solitary endeavor; it relies on a network of brokers facilitating transactions, analysts providing insights, and regulators ensuring fair play and transparency.

2. Stocks: A Glimpse into Ownership:

Stocks represent fractional ownership in a company. When you purchase a share of a company’s stock, you essentially become a part-owner, entitled to a portion of its profits and voting rights. Companies issue stocks to raise capital, allowing them to expand, innovate, or simply sustain their operations. The price of a stock reflects the collective belief of investors in its future value and profitability.

Image: studylib.net

3. The Market’s Pulse: Trading and Prices:

The stock market is a dynamic arena where prices constantly fluctuate based on a complex interplay of factors. Demand – the desire for a stock – and supply – the availability of stocks for sale – are the key drivers of price movements. When demand for a stock exceeds supply, its price rises. Conversely, when supply outweighs demand, the price falls. These price changes are often influenced by news, economic indicators, company performance, and even market sentiment.

Essential Strategies for Stock Market Success:

1. The Power of Diversification: Spreading Your Risk:

Few things are as certain as the unpredictability of the stock market. A well-diversified portfolio is your armor against unexpected downturns. By investing in a range of stocks across different sectors and industries, you reduce the impact of a single company’s performance on your overall portfolio. Just as you wouldn’t put all your eggs in one basket, don’t rely solely on a handful of stocks.

2. Understanding Your Risk Tolerance:

Investing is not a one-size-fits-all endeavor. Before you dive into the stock market, take the time to understand your own personal risk tolerance. Some individuals can stomach the volatility of high-growth stocks, while others prefer the stability of blue-chip companies. Your risk tolerance should determine the proportion of your portfolio allocated to high-risk, high-reward stocks versus low-risk, steady-growth stocks.

3. The Art of Fundamental Analysis:

Fundamental analysis delves into the nitty-gritty of a company’s performance, allowing you to evaluate its true worth. Examining company financials, industry trends, management quality, and competitive landscape helps you make informed decisions. A company with a solid track record, strong financial health, and a promising future is more likely to generate value for its shareholders.

4. Navigating the Tides of Technical Analysis:

Technical analysis views the stock market through the lens of historical price patterns, trading volume, and other technical indicators. By deciphering these patterns, you can identify potential trends, support levels, and resistance levels. This approach can help you time your entry and exit points, but it’s important to remember that past performance is not necessarily indicative of future results.

The “You Can Be a Stock Market Genius” Philosophy: A Blueprint for Success:

The “You Can Be a Stock Market Genius” concept emphasizes a holistic approach to stock market mastery, encompassing both technical and fundamental analysis, alongside a thorough understanding of market psychology and risk management. It encourages you to develop a distinct investment style, tailor-made to your individual goals and risk tolerance.

1. Embracing Long-Term Investing:

The stock market is not a get-rich-quick scheme. It’s a marathon, not a sprint. Successful investors invest for the long term, allowing their investments to compound over time. By buying and holding stocks for the long haul, you ride out market fluctuations, benefitting from the inherent growth potential of profitable companies.

2. The Importance of Patience and Discipline:

The stock market can be a roller coaster ride of emotions. It’s easy to get swept up in the hype and panic when prices rise and fall dramatically. But staying calm and disciplining your emotions is crucial to making rational decisions. Remember to stick to your investment plan, avoid impulsive trading, and let your investments grow steadily over time.

3. Building a Solid Foundation:

Before you start trading stocks, invest time and effort into understanding the basics of the stock market, investing strategies, risk management, and financial literacy. The “You Can Be a Stock Market Genius” PDF resource can be an invaluable guide, providing you with a comprehensive arsenal of knowledge and insights to navigate the complexities of the market.

4. Continuous Learning and Growth:

The stock market is constantly evolving, so your learning should never stop. Stay informed about industry news, economic trends, and investment strategies. Read books, attend seminars, and engage with online communities to expand your knowledge and refine your investment skills.

You Can Be Stock Market Genius Pdf

Conclusion: Unlocking Your Potential in the Stock Market:

Becoming a stock market genius is not about possessing magical powers, but about arming yourself with the right knowledge, strategies, and mindset. By understanding the fundamentals, developing a disciplined approach, and embracing continuous learning, you can navigate the sometimes-treacherous waters of the stock market with confidence. Remember, success in this arena is a journey, not a destination. Embrace the challenge, commit to your personal growth, and unlock the potential for financial success that lies within.