Have you ever found yourself staring at your credit report, wondering how that seemingly innocent online quiz you took turned into a hard inquiry? Or how a seemingly harmless debt collection notice suddenly appeared on your report? The unfortunate reality is that inaccurate or misleading information can creep onto our credit reports, affecting our financial standing and even our ability to secure loans or rentals. This is where the power of a well-crafted letter comes in. A carefully composed letter to the credit reporting agencies can be instrumental in removing inaccurate information from your credit report and reclaiming your financial reputation.

Image: old.sermitsiaq.ag

This letter plays a crucial role in the process of disputing inaccurate information on your credit report. It serves as a formal request to the credit bureaus—Equifax, Experian, and TransUnion—to investigate and potentially remove the contested information. The letter is your opportunity to clearly articulate your case, provide supporting evidence, and ultimately, gain control over your credit narrative. This article will guide you through crafting an effective letter and equip you with valuable tips to ensure a successful outcome.

Understanding the Importance of Clean Credit

Your credit report is essentially a financial resume, detailing your borrowing and repayment history. Lenders, landlords, and even employers use this report to assess your creditworthiness. A blemish on your credit score, even an inaccurate one, can significantly affect your ability to get approved for loans, rent a property, or even land a job. Therefore, maintaining a meticulously accurate credit report is paramount to your financial well-being and future opportunities.

Reasons for Inaccurate Information on Your Credit Report

Several factors can lead to inaccurate credit reporting. Common reasons include:

- Identity Theft: The most serious scenario involves identity theft, where someone else uses your personal information to open accounts, take out loans, or make unauthorized purchases in your name.

- Mistakes by Creditors: Mistakes happen, and creditors sometimes report incorrect information to the credit bureaus. This can include errors in account numbers, balances, payment histories, or even the reporting of a closed account as open.

- Outdated Information: Credit reporting agencies rely on data provided by creditors. If a creditor hasn’t updated their records, outdated information might appear on your report, such as a negative entry from a debt you’ve already settled.

- Fraudulent Accounts: In some instances, fraudulent accounts may appear on your report, created by individuals pretending to be you.

- Data Entry Errors: Simple human error in data entry by creditors or the credit reporting agencies can lead to inaccuracies on your report.

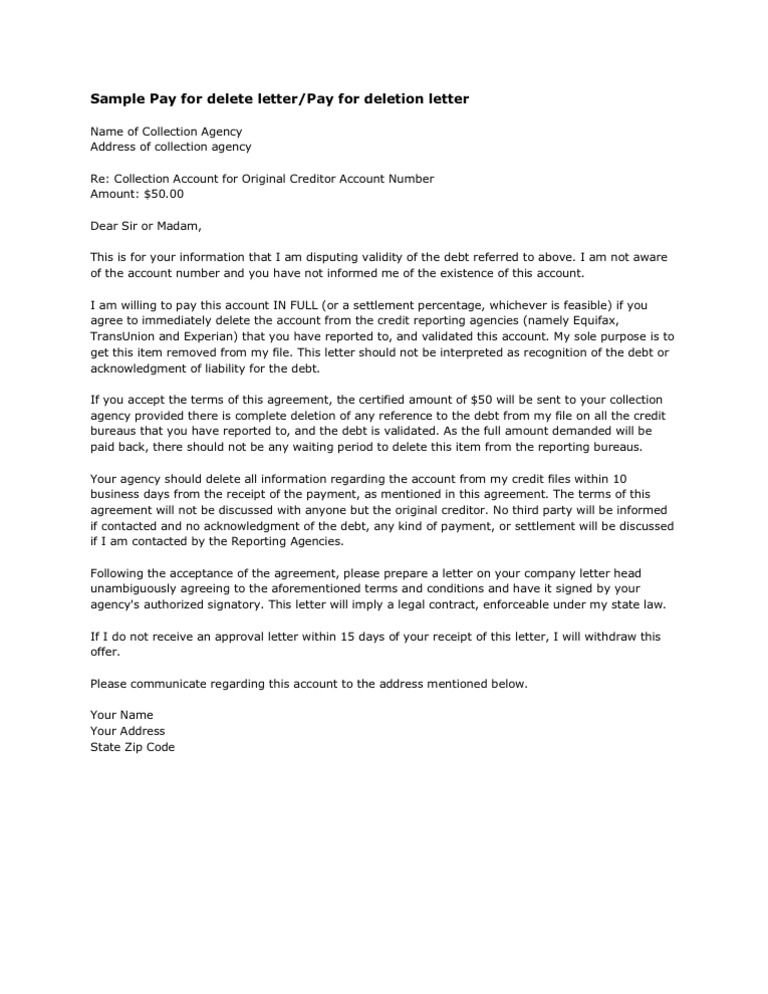

Sample Letter to Remove Personal Information from Credit Report

Here is a sample letter you can use to send to the credit reporting agencies. Remember, it’s essential to personalize it with your specific situation and provide as much detail as possible.

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Credit Reporting Agency Name]

[Address of Credit Reporting Agency]

[Subject: Dispute of Inaccurate Information on Credit Report – Account Number: [Account Number]]

Dear Sir/Madam,

I am writing to dispute the following inaccurate information on my credit report:

[Account Number]: [Account Type] with [Creditor Name]

[Reason for Dispute]: [Clearly state the reason for the dispute, providing specific details. For example, “The account is reported as ‘past due,’ but I have proof of payment.”]

[Evidence]: [Attach copies of supporting documentation. For example, a copy of your credit card statement showing payment history or a copy of the settlement agreement for a resolved debt.]

I request that you immediately investigate this matter and remove the inaccurate information from my credit report.

I understand that I have the right to a free copy of my credit report from each of the major credit bureaus annually. I would appreciate it if you could provide me with a revised copy of my credit report once the dispute has been resolved.

Thank you for your time and attention to this matter.

Sincerely,

[Your Signature]

[Your Typed Name]

Image: www.printablereceipttemplate.com

Tips for Writing an Effective Dispute Letter

To increase your chances of success, consider these important tips:

- Be Specific: Clearly identify the account in question, including the account number and creditor’s name.

- State your Reason Clearly: Explain precisely why you believe the information is inaccurate, provide detailed facts, and avoid vague or general statements.

- Provide Supporting Documentation: Include copies of any relevant documents that support your claim, such as receipts, payment confirmations, or official communication from the creditor.

- Include Your Contact Information: Ensure your contact information is clear and accurate so the credit bureau can reach you if they need further clarification.

- Send a Certified Mail: Send the dispute letter via certified mail with return receipt requested. This provides you with proof of delivery and ensures that your letter was received by the credit bureau.

- Keep a Copy for Your Records: Maintain a copy of the letter and any supporting documentation for your reference.

- Follow Up: Monitor the status of your dispute with regular follow-up calls or emails to the credit bureau.

Further Steps if Your Dispute is Unsuccessful

If the credit reporting agency does not resolve the dispute to your satisfaction, you have options. You can file a formal complaint with the Consumer Financial Protection Bureau (CFPB) or contact the credit bureau’s dispute resolution department for further escalation.

Sample Letter To Remove Personal Information From Credit Report

Conclusion

Maintaining an accurate credit report is crucial for your financial well-being. By sending a well-crafted letter to the credit bureaus, you can initiate the process of removing inaccurate information from your report. Remember to be clear, specific, and provide supporting documentation. By taking the necessary steps, you can regain control over your credit narrative and secure a strong financial foundation.

Remember, this information is for informational purposes only and should not be considered legal or financial advice. It is always recommended to consult with a qualified legal professional or financial advisor for personalized guidance on your specific circumstances.