Have you ever heard of a CPN number and wondered what it is? Or maybe you’ve seen online ads promising “financial freedom” with a CPN? The truth is, CPN numbers are often associated with scams and misleading information. While it might sound like a way to gain a fresh financial start, it’s crucial to understand the risks involved and what a CPN actually is.

Image: www.goodreads.com

In this comprehensive guide, we will dive deep into the world of CPN numbers, unraveling the myths surrounding them. We will explore the origins of the term, its real-world applications, and the potential dangers of using a CPN to manipulate credit or evade debt. By exploring all sides of the story, we aim to empower you with the knowledge to make informed decisions about your finances.

What is a CPN Number?

CPN stands for “Credit Privacy Number,” and it’s often marketed as an alternative to your Social Security Number (SSN). The claim is that it can help you avoid debt collectors, improve your credit score, and even open new bank accounts without affecting your existing financial history.

However, here’s the catch: **CPNs are not recognized by any legitimate financial institution or government agency.** They are not regulated, and their use is often linked to fraudulent activities. The IRS, Social Security Administration, and credit reporting agencies such as Experian, Equifax, and TransUnion all rely on your SSN to identify you financially.

The Origins of the CPN Myth

The concept of a CPN stemmed from the rise of identity theft and the desire for privacy in the digital age. People worried about their personal data being compromised started seeking alternative methods to manage their finances. The creation of a fake “credit profile” using a CPN seemed like an attractive solution.

However, this idea quickly became a target for salespeople with dubious intentions. They began promoting CPNs as a shortcut to financial freedom, offering to create them for a fee. The reality is, there is no government-approved process for obtaining a CPN, and it’s usually just a fabricated number with no actual value.

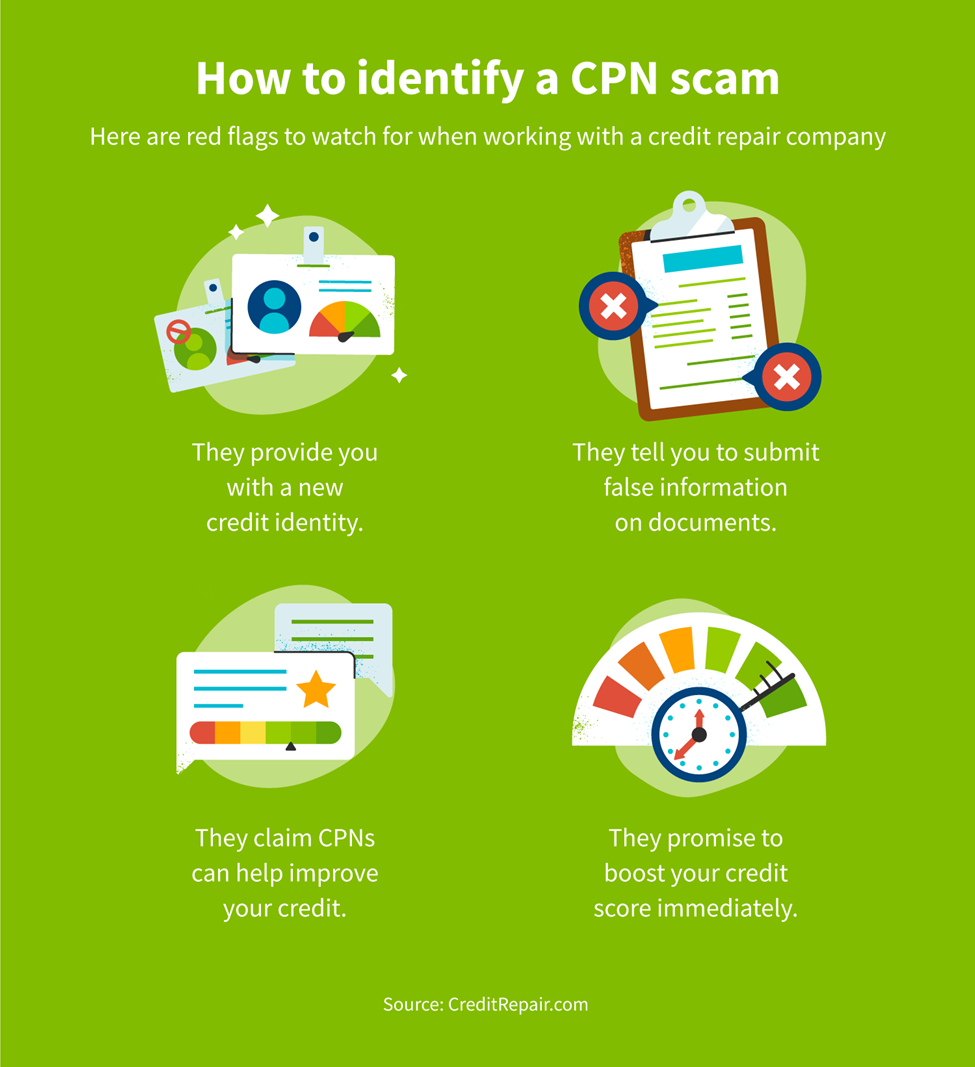

How CPN Scams Work

Here’s a typical scenario: You come across an enticing advertisement promising financial miracles with a CPN. The ad might offer benefits like:

- Escape mounting debt

- Boost your credit score effortlessly

- Open credit cards with higher limits

- Protect your identity from fraud

The vendor might ask for personal details, including your Social Security Number, to “create” your CPN. They may also charge you a hefty fee for their services. The problem is, you won’t receive anything legitimate. Instead, you’ll likely get a randomly generated number with no official recognition.

Image: www.creditrepair.com

The Dangers of Using a CPN

The use of CPNs often leads to serious consequences, including:

- Identity theft: When sharing your actual information, you risk it being used for fraudulent purposes.

- Financial ruin: Using a fabricated number can lead to legal repercussions and financial damage.

- Criminal charges: Trying to use a CPN to commit fraud is illegal and can result in severe penalties.

How to Protect Yourself

Here’s how to avoid falling victim to CPN scams:

- Be skeptical of online ads: If something sounds too good to be true, it probably is.

- Research carefully: Look for trusted sources of information about financial matters.

- Consult with professionals: If you have concerns about your credit, seek advice from reputable financial advisors or credit counselors.

Building a Strong Financial Future

Instead of seeking shortcuts, prioritize building healthy financial habits. This includes:

- Understanding your credit report: Get a free copy of your credit report annually from all three major credit bureaus.

- Paying bills on time: This is crucial for maintaining a good credit score.

- Managing your debt responsibly: Create a budget, explore debt consolidation options, and prioritize debt repayment.

- Saving regularly: Set financial goals and work towards achieving them through consistent saving practices.

How To Make A Cpn Number

Conclusion

The allure of a quick fix for financial challenges might seem appealing, but CPNs are a dangerous illusion. Instead of chasing deceptive promises, focus on building a solid financial foundation through responsible habits, informed decisions, and the guidance of trusted professionals. Always remember that your financial well-being is paramount, and choosing a safe and legitimate path is crucial for a secure and prosperous future.