Have you ever wondered how your money magically appears in your bank account after a deposit or how a credit card purchase magically disappears from your balance after you pay it off? Behind these seemingly simple transactions lies a complex web of accounting principles, rules, and statements that ensure your financial life runs smoothly. Understanding the basics of accounting can empower you to make informed financial decisions, from managing your personal finances to investing in the stock market.

Image: www.iedunote.com

In this article, we will delve into the world of accounting, exploring the key concepts that underpin the creation and analysis of financial statements. We will focus on the question of “which statement about an account is true?” We’ll shed light on the different types of accounts, their fundamental characteristics, and how they work together to paint a comprehensive picture of your financial health. Buckle up and get ready for an exciting journey into the heart of accounting!

Understanding the Basics of Accounting

At its core, accounting is the process of recording, classifying, summarizing, and analyzing financial transactions. It helps individuals and organizations track their financial performance, identify trends, make informed decisions, and ensure financial accountability. Imagine accounting as a skilled storyteller, weaving a captivating narrative of your financial journey through a carefully crafted set of statements.

To understand these financial statements, it’s essential to learn the language of accounting. Think of accounting as a foreign language. Just as learning French requires understanding verbs, nouns, and adjectives, understanding accounting requires understanding the fundamental building blocks of accounting – the accounts.

The Different Types of Accounts

Accounts are essentially containers that hold specific types of financial information. Think of them as folders in your computer, each dedicated to a specific type of data. These financial folders can be categorized into two main types: assets and liabilities.

Assets: What You Own

Assets represent everything of value that you own or control. Think of assets as your financial “possessions,” whether cash in the bank, investments in the stock market, or your beloved vintage car. They are a crucial part of your financial picture, reflecting both the present value of your possessions and their potential to generate future income.

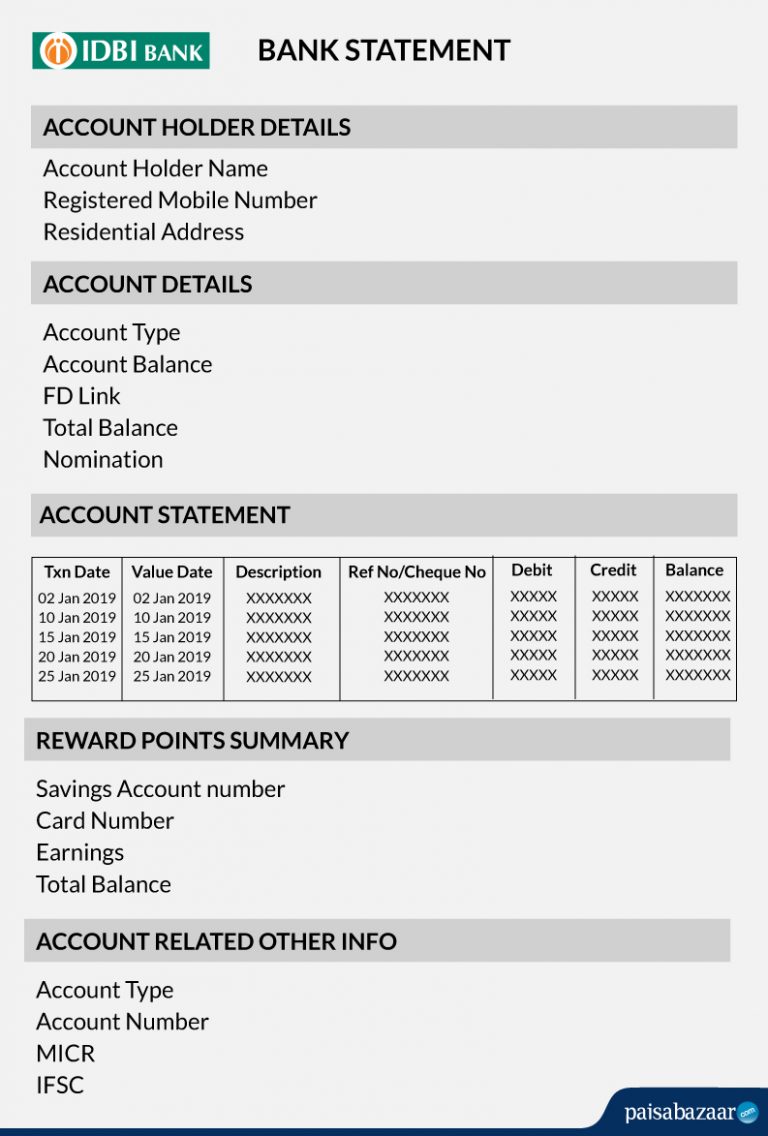

Image: www.paisabazaar.com

Examples of Assets

-

Cash: This refers to the actual money you have on hand or in a bank account.

-

Accounts Receivable: This represents money owed to you by customers for goods or services already delivered.

-

Inventory: If you are a business, this is the raw materials or finished products you have in stock to sell.

-

Land and Buildings: Real estate, which can be both an investment and a place to live or work.

-

Equipment: Machines, furniture, and fixtures used in your business or your personal life.

Liabilities: What You Owe

Liabilities represent what you owe to others, your financial “obligations.” They are the flip side of the asset coin, indicating what you must pay back, whether it’s a loan from a bank, a credit card bill, or taxes owed to the government. Liabilities play a crucial role by reflecting your financial commitments and the degree of financial leverage you are using.

Examples of Liabilities

-

Accounts Payable: This refers to the money you owe to suppliers for goods or services already received.

-

Notes Payable: This term encompasses loans you have taken from banks or other institutions.

-

Mortgages: This refers to a long-term loan used to purchase a property.

-

Taxes Payable: The amount of taxes you owe to the government.

The Balance Sheet: A Snapshot of Your Financial Health

Now that we have explored the building blocks of accounts, let’s begin to assemble them into a complete picture. The balance sheet is a financial statement that provides a snapshot of an organization or individual’s financial position at a specific point in time. It captures what you own (assets) and what you owe (liabilities) at a set moment, like taking a picture of your financial world.

The fundamental principle of the balance sheet is the accounting equation, which states that assets are always equal to the sum of liabilities and owner’s equity.

- Assets = Liabilities + Owner’s Equity

This equation is essentially the backbone of accounting, ensuring every transaction is balanced and accounted for.

Owner’s Equity: Your Stake in the Game

Owner’s equity represents the owner’s stake in the business or an individual’s net worth. It’s the difference between what you own (assets) and what you owe (liabilities). A positive owner’s equity signifies that the individual or business has a financial cushion, while a negative equity means that the individual or business owes more than they own.

Example of Owner’s Equity

Imagine a small business that owns a $100,000 piece of equipment (asset) and has a $50,000 loan from a bank (liability). The owner’s equity in this business would be $50,000 ($100,000 – $50,000). This means that the owner has a net worth of $50,000 in this business.

The Income Statement: Tracking Your Financial Performance

The income statement is another critical financial statement that tells the story of an organization or individual’s financial performance over a specific period, usually a month, quarter, or year. It summarizes the revenues generated and expenses incurred during that time, revealing the profitability or loss of the business or individual.

Example of Income Statement

Imagine a small business generated $100,000 in revenue from sales but incurred $60,000 in expenses during the year. The net income of this business would be $40,000 ($100,000 – $60,000). A positive net income represents profitability, while a negative net income signals a loss.

The Statement of Cash Flows: The Movement of Money

The statement of cash flows, as the name suggests, focuses specifically on the movement of cash within an organization or individual’s financial system. It provides insight into the sources and uses of cash, helping analyze an entity’s ability to generate cash, pay its debts, and fund its operations.

There are three main types of cash flow activities:

-

Operating Activities: These activities stem directly from the core business operations, such as sales, purchases, and payment of expenses.

-

Investing Activities: These activities involve the acquisition and disposal of long-term assets (like property, plant, and equipment), along with investments in other businesses.

-

Financing Activities: These activities concern obtaining and repaying capital, for example, taking out loans, issuing stocks, and paying dividends to shareholders.

Understanding Financial Statements: A Key to Success

Now that we have navigated the basics of accounting, let’s revisit the concept of “which statement about an account is true?”

Each financial statement – the balance sheet, income statement, and statement of cash flows – provides crucial information about an individual or organization’s financial state.

The balance sheet offers a snapshot of what the organization owns and owes at a specific point in time. The income statement provides a summary of revenues, expenses, and profitability over a period. The statement of cash flows reveals the sources and uses of cash within an entity.

Through careful analysis of these statements, you can understand the financial health of the organization or individual, identify trends, and make informed decisions to improve financial performance.

Which Statement About An Account Is True

The Importance of Financial Literacy in Every Area of Life

In today’s complex financial world, understanding the language of accounting is not just beneficial; it’s indispensable. Whether you’re managing your personal finances, starting a business, or investing in the stock market, financial literacy provides a foundation for making smart decisions and achieving your financial goals.

By learning the basics of accounting, you can decode the language of financial statements, analyze your financial performance, and gain the tools you need to take control of your financial future.