Picture this: You’re knee-deep in spreadsheets, pouring over your business finances, trying to make sense of your cash flow. You pull up your Bank of America business bank statement, and it’s a sea of numbers, codes, and confusing jargon. What can you decipher from these seemingly random figures? The good news is, you don’t need a finance degree to understand your business bank statement. This detailed guide will empower you to navigate your Bank of America business bank statement with confidence and turn it into a valuable tool for informed financial decisions.

Image: dl-uk.apowersoft.com

In the dynamic world of entrepreneurship, managing your business finances is crucial. A business bank statement, specifically from a trusted institution like Bank of America, acts as a comprehensive record of all your business transactions. This statement is much more than just a list of deposits and withdrawals; it’s a valuable tool that provides insights into your financial health, spending habits, and overall business performance. Understanding the intricate details of your bank statement can help you analyze your financial position, identify potential areas for improvement, and make informed decisions that contribute to your business growth.

Interpreting Your Bank of America Business Bank Statement

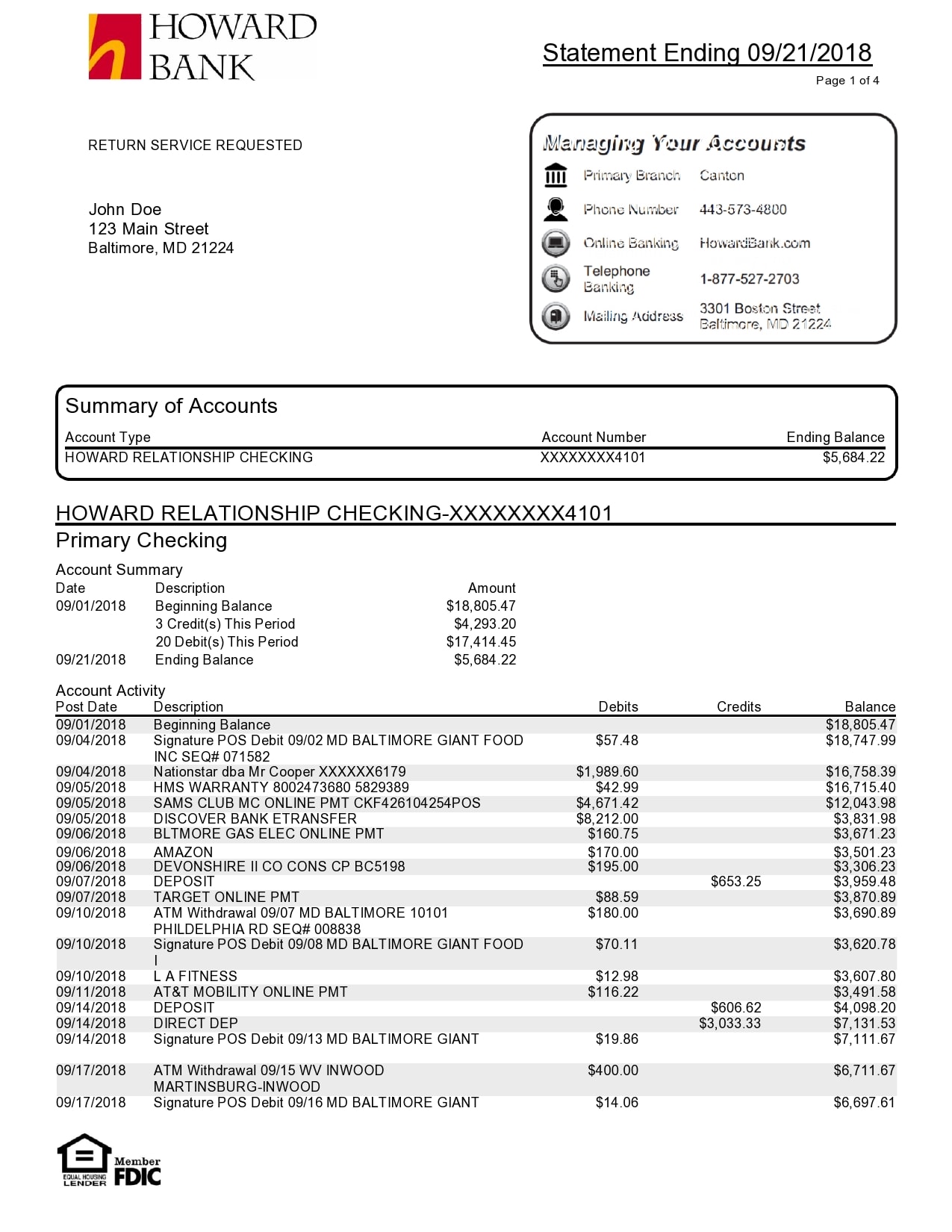

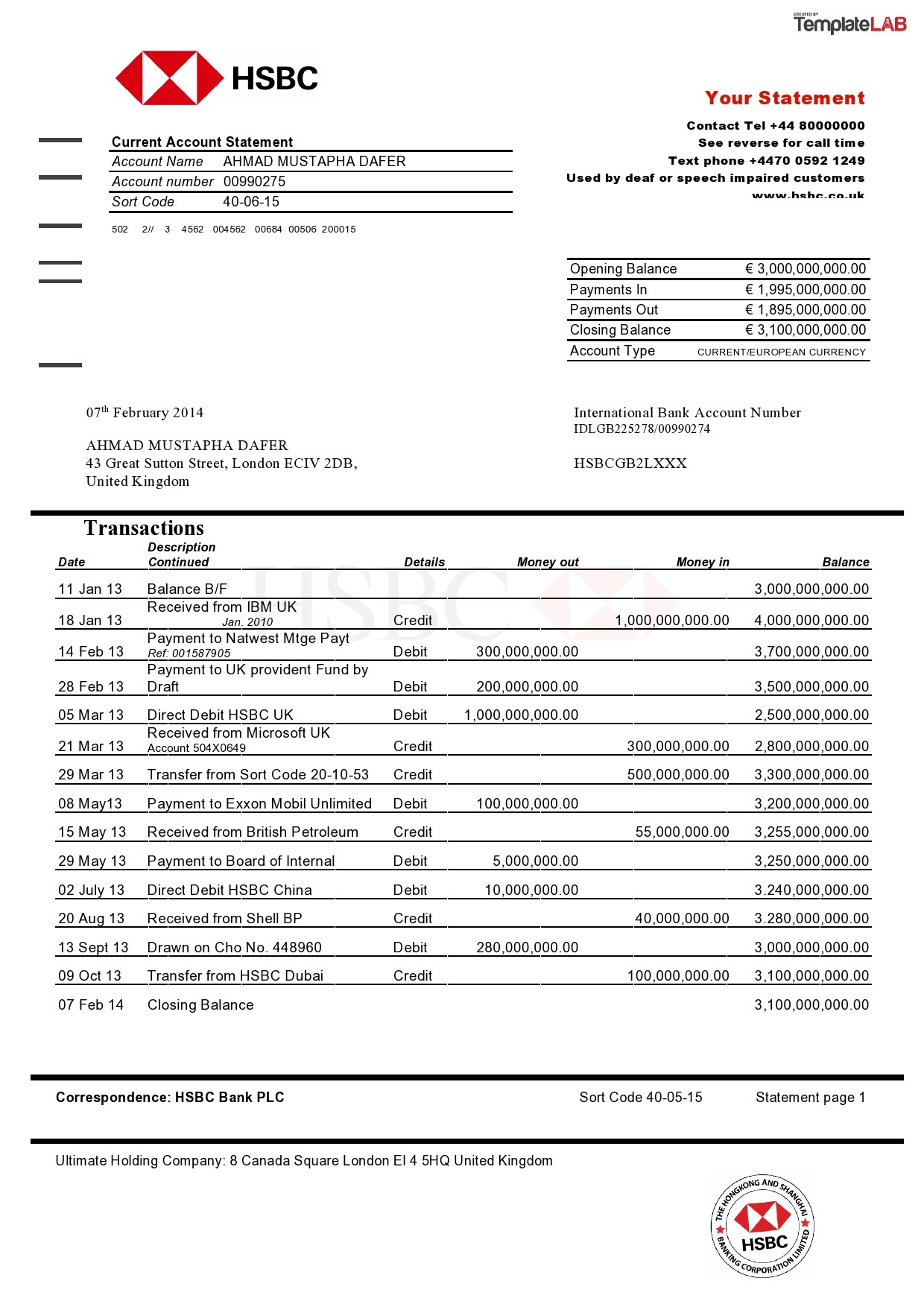

Navigating the Statement Layout

Many business owners find the layout of their bank statement rather confusing at first. But fear not, it’s actually a well-structured document, and Bank of America provides a user-friendly format. The topmost section will usually display your account information, including your account number, name of the business, and the statement period covered. The next section details the opening balance of your account. Following this is the heart of the statement, the “Transactions” section. This is where all the transactions you’ve made (deposits, withdrawals, payments, etc.) are listed in chronological order. Lastly, the statement will display the closing balance as of the end of the period.

Unveiling the Transactions

Within the “Transactions” section, each entry provides crucial information about your business activities. The first element is the transaction date, indicating when the transaction occurred. The second element is the description of the transaction. This might be a vendor name, a payee, a deposit slip number, or a specific description of the transaction. Next, the statement will list the transaction amount, which could be either a debit (withdrawal) or a credit (deposit). The final element is often a note or reference number, which is particularly helpful for tracking specific transactions.

Image: printabletemplate.concejomunicipaldechinu.gov.co

Decoding the Common Symbols

Just like any other financial document, Bank of America’s business bank statements use abbreviations and symbols to represent certain types of transactions. Here’s a breakdown of the most common symbols:

- Debit (Dr.): This signifies money that has been deducted from your account.

- Credit (Cr.): This signifies money that has been added to your account.

- ACH: This stands for Automated Clearing House, used for electronic payments and transfers.

- POS: This means Point of Sale, often used for payments made with debit or credit cards.

- NSF: This stands for Non-Sufficient Funds, indicating that a transaction was attempted but failed because there wasn’t enough money in the account.

Familiarizing yourself with these frequently used symbols can make interpreting your statement a lot easier.

Understanding the Importance of Reconciliation

Reconciling your bank statement is a fundamental step in managing your business finances. This process involves comparing the transactions listed on your bank statement with your own internal records (like your checkbook or accounting software) to ensure accuracy. By reconciling your statement, you can catch any discrepancies, such as missed payments, fraudulent transactions, or accounting errors.

Steps to Reconciliation

Bank of America offers online tools to simplify reconciliation. Here’s a general overview of the steps:

- **Obtain your bank statement.** Download or request the latest statement from your Bank of America online banking portal.

- **Review your internal records.** This includes your checkbook register, invoices, and other financial documents.

- **Match transactions.** Compare each transaction on your bank statement with your records, noting any differences.

- **Investigate discrepancies.** Investigate any discrepancies carefully. This might involve contacting vendors, checking for duplicate payments, or verifying payments made with your credit cards.

- **Adjust your records.** Update your records to accurately reflect the transactions on your bank statement.

Using Your Bank Statement for Business Insights

Beyond simply tracking transactions, your Bank of America business bank statement can provide invaluable insights into your business finances. By analyzing your statement, you can gain a better understanding of your cash flow, identify spending patterns, and spot potential areas for improvement.

Monitoring Cash Flow

Cash flow is the lifeblood of any business. Your bank statement provides a clear picture of how money is moving in and out of your business. By analyzing the transaction patterns, you can determine if you have a positive cash flow (more money coming in than going out) or negative cash flow (more money going out than coming in). This information is essential for making informed decisions about expenses, investments, and business growth.

Analyzing Spending Patterns

Your bank statement reveals your spending habits. By categorizing your expenses (e.g., rent, utilities, marketing, payroll), you can identify areas where you’re overspending or where you might have room for savings. This analysis allows you to prioritize spending and make adjustments to optimize your business finances.

Gaining a Financial Outlook

Your bank statement is an excellent tool for assessing your business’s overall financial health. By tracking your income and expenses over time, you can analyze trends, identify potential risks, and make informed decisions about the future direction of your business. It’s a key tool for projecting your financial performance and making well-informed decisions about growth strategies.

Leveraging Bank of America’s Online Tools

Bank of America provides a suite of online tools that can help you manage your business finances more effectively, using your bank statement as a powerful source of information.

Online Banking

Bank of America offers a user-friendly online banking portal that allows you to access your bank statements, check your account balance, transfer funds, and pay bills, all from the convenience of your computer or mobile device. This streamlined solution makes managing your finances a lot easier.

Mobile App

The Bank of America Mobile App is a handy tool for staying on top of your financials, even when you’re busy. You can download the app on your smartphone or tablet and access features like account balances, recent transactions, statement viewing, bill pay, and more, anytime, anywhere.

Business Online Banking

For advanced business needs, Bank of America offers a comprehensive Business Online Banking platform. Through this platform, you can access tools like account aggregation, cash flow management, and budgeting features. You can also connect to accounting software for seamless integration of your financial data.

Additional Resources for Business Owners

Beyond analyzing your statement, Bank of America offers a range of resources to support you in managing your business finances.

- Business Loan Products: From working capital loans to equipment financing, Bank of America offers a variety of loan options tailored to the specific needs of your business.

- Merchant Services: Bank of America provides various merchant services, including credit card processing, point-of-sale systems, and fraud prevention tools.

- Business Advisory Services: Bank of America offers advisory services that provide expert guidance on financial planning, cash flow management, and business strategy.

- Business Insights and Resources: Bank of America’s website features valuable business insights, articles, and resources that cover topics like accounting, marketing, and financial planning.

Bank Of America Business Bank Statement

Conclusion

Understanding your Bank of America business bank statement is essential for informed financial decisions in your business. By using the tools and resources provided by Bank of America, you can turn your statement into a powerful tool for analyzing your finances, understanding your spending habits, and making informed decisions that contribute to your business growth. Embrace the information it provides, and let your bank statement become your guide to success in the entrepreneurial journey.