Have you ever felt a pang of frustration when you see a series of inquiries on your credit report? You know you applied for a few things, but it feels like your credit score is taking a beating from all these inquiries. Perhaps you’re trying to buy a home, secure a loan, or simply want to build a strong financial foundation. You’re not alone. Inquiries can be a significant roadblock on the path to financial stability, but the good news is, there’s a way to address them: a well-crafted credit repair letter.

Image: templates.rjuuc.edu.np

In this comprehensive guide, we’ll delve into the world of credit repair letters, uncovering the secrets behind their effectiveness and empowering you to take control of your credit score. We’ll explore the ins and outs of inquiries, the power of these letters, and provide actionable tips to help you write and send your own with confidence.

Credit Inquiries: What You Should Know

Credit inquiries represent requests to review your credit history. These inquiries are generally categorized into two groups:

- Hard inquiries: These occur when lenders or creditors access your credit report to make a decision about your loan application. They typically have a negative impact on your credit score, but are inevitable when seeking financial products like mortgages, auto loans, or credit cards.

- Soft inquiries: These inquiries are less impactful on your credit score because they are often initiated for purposes like pre-approvals or when you check your own credit report. Businesses use these inquiries to gauge your creditworthiness without affecting your score.

While some inquiries are unavoidable, it’s crucial to understand that too many inquiries can negatively impact your credit score. Each hard inquiry remains on your report for two years, contributing to a higher credit utilization rate, which impacts your score. Moreover, multiple inquiries can raise red flags to future lenders, potentially hindering your loan approvals.

The Power of a Credit Repair Letter

A credit repair letter is a concise and focused communication that you send to credit bureaus to dispute inaccurate or unverifiable information on your credit report. While not a magic bullet for all credit woes, these letters can be incredibly powerful when used strategically.

Here’s why a credit repair letter can be effective at removing inquiries:

- Documentation: By carefully reviewing your credit report and noting the specific inquiry, you can send a letter to the credit bureau highlighting discrepancies or errors in the record. Lack of documentation or proper verification can make the inquiry appear unreliable, leading to its removal.

- Justification: A well-written letter provides solid evidence of why the inquiry should be removed. You can showcase your efforts to resolve debts or secure necessary authorizations for credit access, ultimately bolstering your case for removal.

- Legal Protection: The Fair Credit Reporting Act (FCRA) empowers consumers to dispute errors on their credit report and gives credit bureaus a legal obligation to investigate and potentially remove inaccurate information.

Remember, the key to a successful credit repair letter is clarity, accuracy, and a strong argument. This letter isn’t just about complaining, it’s about providing factual evidence to rectify mistaken entries.

Essentials for a Winning Credit Repair Letter

Creating a compelling credit repair letter takes a bit of know-how and attention to detail. Here’s a step-by-step guide to ensure your letter hits the mark:

- Start with a Clear Purpose: Begin by clearly stating your intention to dispute the credit inquiry. Identify the specific inquiry by its date and details.

- Highlight Relevant Information: Include any evidence you have to support your claim. This could include:

- Proof of authorized credit checks (if applicable)

- A copy of your credit report with the inaccurate inquiry highlighted

- Documentation of debt resolution efforts

- Craft a Compelling Argument: Clearly state your reasons for contesting the inquiry. You might argue that you never authorized the credit check, that it was for a reason unrelated to creditworthiness, or that there are inaccuracies in the recorded information.

- Maintain Professional Tone: While expressing your frustration is understandable, keep your tone respectful and professional. Remember, you want to persuade the credit bureau, not antagonize them.

- Demand Specific Action: Clearly articulate what you want the credit bureau to do. Request an investigation into the inquiry and its removal from your credit report if it’s deemed inaccurate.

- Include Contact Information: Provide your full name, address, phone number, and email address to ensure the credit bureau can reach you easily for further communication.

- Send via Certified Mail: Opting for certified mail allows you to track the letter’s delivery and receive confirmation of receipt, which can be helpful for future reference if additional action is necessary.

- Thoroughly Review Your Report: Before writing your letter, carefully examine your credit report to pinpoint the specific inquiry you want to dispute. Make a note of all relevant details, including the date, company, and credit bureau.

- Contact the Credit Company: Before contacting the credit bureau, reach out to the company that initiated the inquiry. They might be willing to assist in getting the inquiry removed, thus streamlining the process.

- Track Your Progress: Keep detailed records of your correspondence with credit bureaus and companies. This documentation can be valuable if you need to escalate the dispute process.

- Seek Professional Guidance: If you’re facing complex credit repair issues, consider working with a reputable credit repair company. They can provide expert advice and handle the dispute process on your behalf, saving you time and effort.

Image: www.heritagechristiancollege.com

Effective Tips for Credit Repair

Sending a credit repair letter is a vital step toward improving your credit score. Here are some additional tips to optimize your chances of success:

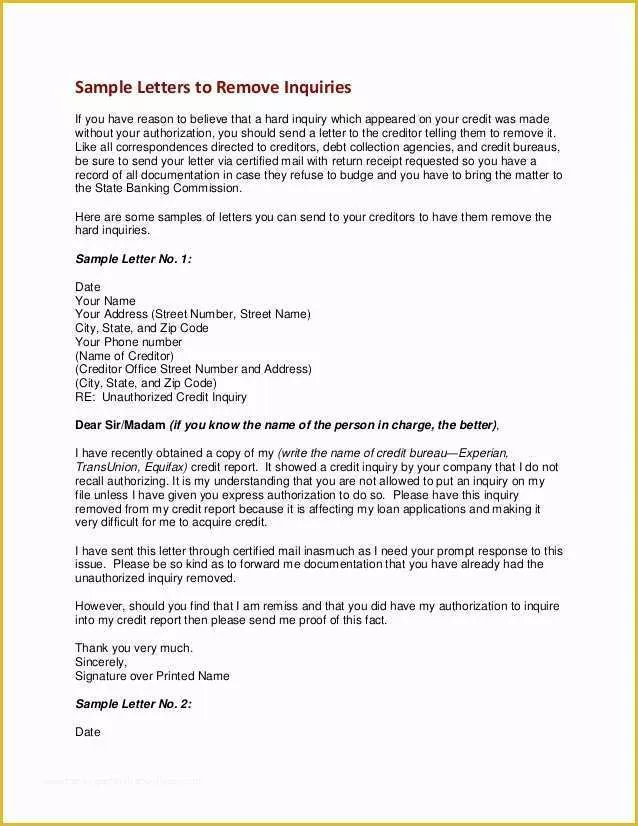

Credit Repair Letter To Remove Inquiries

Conclusion: Your Journey to a Stronger Financial Future

Disputing credit inquiries can be a proactive step towards building a strong credit history. A well-crafted credit repair letter, backed by documentation and a compelling argument, can help remove inaccuracies from your credit report, potentially paving the way for a higher score, more favorable loan terms, and a more stable financial future.

Remember, your credit score reflects your financial responsibility. By advocating for yourself and addressing potential errors, you take control of your financial narrative and establish a foundation for personal and financial growth. Stay informed, act strategically, and don’t hesitate to seek assistance from reputable sources to navigate the credit repair process effectively.