Imagine a world where you could access your money anytime, anywhere, with just a simple swipe of a card. This is the convenience offered by an ATM card, and for millions of customers across India, the State Bank of India (SBI) is their gateway to this financial freedom. But how does one navigate the application process for this valuable tool? The journey to obtaining your SBI ATM card starts with a simple form, and this guide will demystify every step for you.

Image: www.vrogue.co

Understanding the intricacies of the application form ensures a smooth process and helps you avoid any unnecessary delays. This article serves as your comprehensive toolkit, offering insights into the essential requirements, submission methods, and potential complications that might arise during the application process. By the end, you’ll be well-equipped to navigate the SBI ATM card application form with confidence and clarity.

Step 1: Gathering Your Essentials

Before you start filling out the application form, it’s crucial to assemble all the necessary documents and information. This will ensure a hassle-free experience and prevent any last-minute scrambling. Here’s a checklist of what you’ll need:

- SBI Account Details: Your account number, branch name, and IFSC code are essential for linking your card to your account.

- Valid Identification Proof: This could be your Aadhaar card, PAN card, passport, or driving license. Make sure the details on the ID match your account details.

- Recent Photograph: A passport-sized photograph is typically required for the application form.

- Mobile Number and Email Address: These are crucial for communication regarding your application status and further updates.

- Application Form: The form itself can be downloaded online or obtained from your nearest SBI branch.

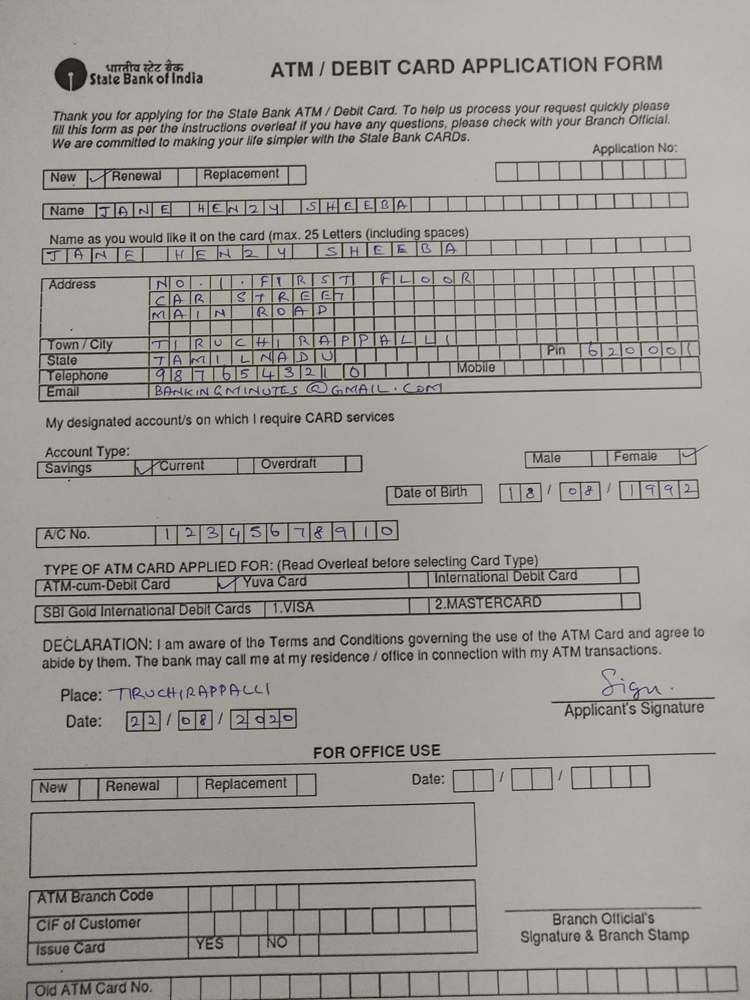

Step 2: Filling Out the Application Form

With your documents ready, it’s time to tackle the application form itself. The form is designed to be straightforward and user-friendly, but it’s important to pay attention to each section to avoid any errors:

Personal Information

This section requires your basic details, including your name, address, mobile number, and email address. Enter this information accurately and double-check for any typos. Consistency is key, especially when it comes to your name and address across all documents.

Image: www.youtube.com

Account Details

Here, you’ll provide essential information about the bank account you wish to link your ATM card to. This includes your account number, branch name, and IFSC code. Ensure this information corresponds exactly to your bank records to avoid any complications during card activation.

Card Type and Features

SBI offers various types of ATM cards, each with its own features and benefits. You’ll have the option to choose the type of card that best suits your needs, considering factors like transaction limits, daily withdrawal caps, and additional services such as mobile banking or online shopping. Read through the options carefully to make an informed decision.

Declaration and Signature

The final section of the form requires you to declare that all the information you’ve provided is accurate and complete. You will also need to sign the application form, confirming your acceptance of the card’s terms and conditions.

Step 3: Application Submission

Once you’ve meticulously filled out the form, you have several options for submission:

Online Submission

Submitting your application through the SBI website is convenient and often faster than traditional methods. You can access the application form online and submit it electronically, attaching scanned copies of your required documents.

Branch Submission

If you prefer face-to-face interaction, you can visit your nearest SBI branch to submit your application in person. The branch staff will assist you with the process and answer any questions you may have.

Mobile App Submission

SBI’s mobile banking app allows you to apply for an ATM card directly from your phone. This offers a seamless and efficient way to submit your application on the go.

Step 4: Verification and Processing

Once your application is submitted, SBI will begin verifying your details. This process typically involves contacting you to confirm your mobile number and email address. It’s important to be responsive to these communications as any delay in verification can prolong the card issuance process.

After verification, your application will be processed. During this stage, SBI may require additional documents or information based on your specific application details. This step can take anywhere from a few business days to a couple of weeks depending on the workload and any complexities involved.

Step 5: Card Issuance and Activation

Once your application is approved, SBI will issue your ATM card. The card will be delivered to the address you provided on the application form. The delivery timeframe can vary depending on your location and the mode of delivery chosen.

Upon receiving your card, it’s crucial to activate it to start using it. You can usually activate your card by calling a designated helpline number or by using your mobile banking app. The instructions for activation will be provided with your card or in the delivery notification you receive.

Potential Challenges and Solutions

While the application process for an SBI ATM card is usually smooth, you may encounter some challenges along the way. Understanding these potential pitfalls and having solutions readily available can make the process even more seamless.

Incomplete or Inaccurate Information

Providing incorrect or incomplete information on the application form can delay the process significantly. Carefully review your form before submitting it to ensure everything is accurate. If you realize an error after submission, contact your branch immediately to rectify it.

Document Verification Issues

SBI may require additional documents for verification purposes. Having a valid ID proof, address proof, and recent photograph readily available will ensure a smoother verification process. If you encounter difficulties with document verification, reach out to your branch for assistance.

Application Denial

Although rare, applications can be denied due to issues like insufficient account balance, outstanding dues, or incomplete documentation. If your application is denied, it’s important to inquire about the reason for denial and address any concerns or address any missing information to resubmit your application.

Application Form For Sbi Atm Card

Conclusion: Embracing the Convenience

Navigating the SBI ATM card application form might seem daunting, but with this guide as your companion, the process becomes clear and manageable. From gathering essential documents to carefully filling out the form and understanding potential challenges, you’re now equipped with the knowledge to apply for your SBI ATM card with confidence.

Remember, an ATM card is not just a piece of plastic; it’s a key to a world of financial convenience at your fingertips. With your SBI ATM card, you can access your funds anytime, anywhere, empowering you to manage your financial responsibilities efficiently and seamlessly. So, take the first step toward unlocking your financial freedom!

Note: The information provided in this article is for general guidance only and is subject to change based on SBI’s current policies. Always refer to official SBI documentation and contact your bank branch for the most up-to-date information.