Remember the last time you received a physical bank statement? The paper, the ink, the feeling of holding your financial history in your hands. While those days might be fading into the past for many of us, the importance of understanding your bank statement remains as relevant as ever. In an increasingly digital world, navigating your Bank of America bank statement is more than just checking your balance; it’s about gaining control over your finances and making informed decisions about your money.

Image: softjolo.weebly.com

This guide will provide you with a clear understanding of your Bank of America bank statement, empowering you to confidently track your spending, identify financial patterns, and make strategic choices for your financial well-being. Whether you’re new to banking or a seasoned financial pro, this comprehensive breakdown is here to help you unlock the secrets hidden within your online statement.

Understanding the Anatomy of Your Bank of America Statement

Your online Bank of America statement is more than just a list of transactions; it’s a window into your financial health. The statement features a variety of sections that provide valuable insights into your spending habits, account activity, and overall financial picture.

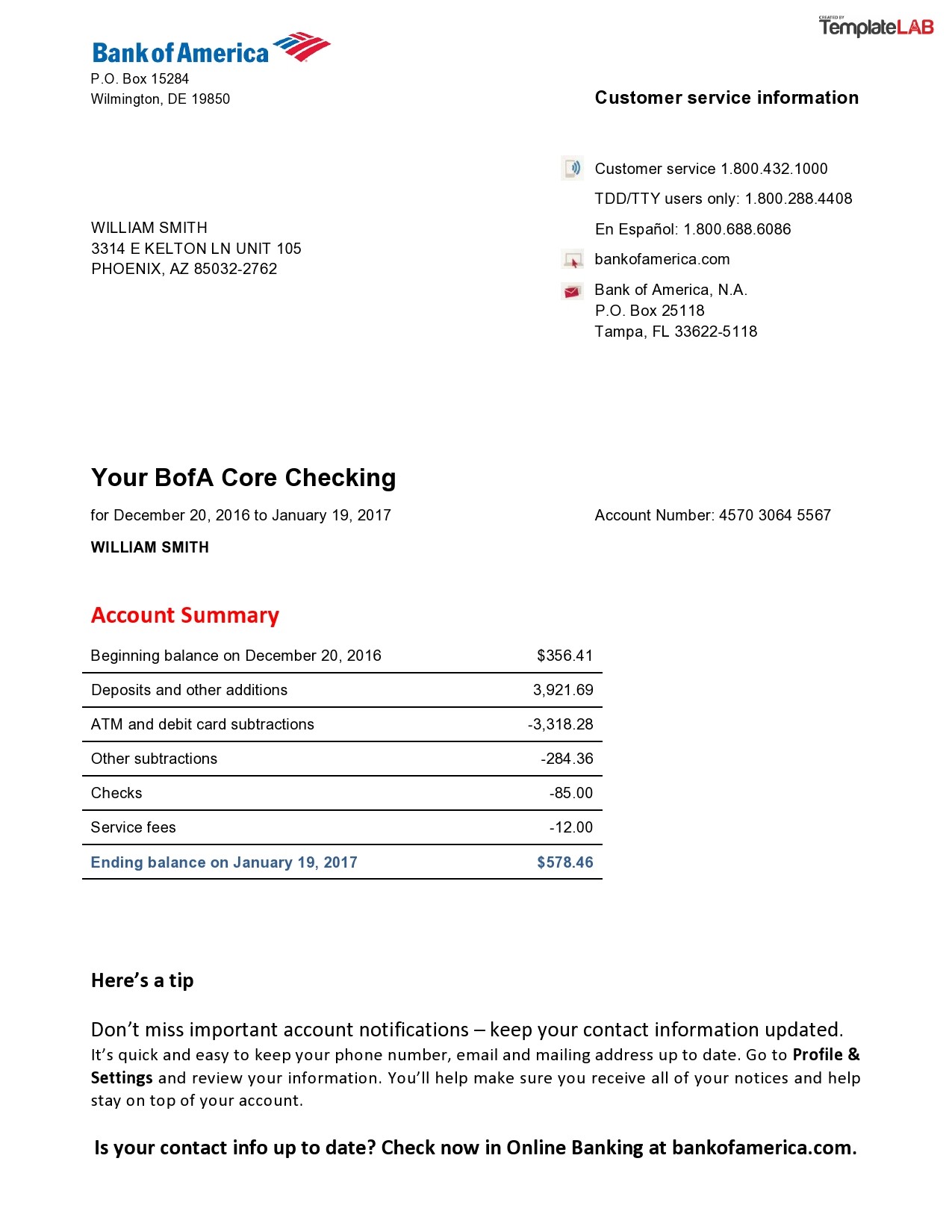

1. Account Summary: A Quick Snapshot of Your Finances

The account summary is the first thing you’ll see when you open your statement. This section gives you a concise overview of your account’s current status, including:

- Account balance: This number represents the total amount of money you have in your account at the time the statement was generated.

- Available balance: This figure shows how much money you have available to spend or withdraw. It takes into account any pending transactions or holds on your account.

- Interest earned: For accounts like savings or money market accounts, this section displays the interest you’ve earned over the statement period.

- Fees: It shows any fees that were assessed to your account during the statement period, such as monthly maintenance fees or overdraft fees.

2. Transaction History: A Detailed Breakdown of Your Spending

The transaction history is the heart of your bank statement. This section chronologically lists every single transaction made on your account during the statement period. Each transaction includes the following essential information:

- Date: When the transaction occurred.

- Description: A brief summary of the transaction.

- Transaction type: Indicates whether the transaction was a deposit, withdrawal, purchase, transfer, or other type of activity.

- Amount: The amount of money involved in the transaction.

- Balance: Your account balance after the transaction is completed.

Image: www.pinterest.com

3. Account Information: Your Account’s Essential Details

The account information section provides vital details about your account, such as:

- Account number: The unique identifier for your account.

- Account type: Indicates whether the account is a checking, savings, money market, or other type of account.

- Statement period: The timeframe covered by the statement.

- Contact information: Your contact information on file with Bank of America, including your name, address, and phone number.

4. Other Essential Information: Beyond the Basics

Depending on your account type and activity, your statement might include additional sections such as:

- Statement charges: Details on any fees or charges associated with your account.

- Overdraft protection: Information about your overdraft protection options.

- Direct deposits: A list of any recurring direct deposits you receive.

- Payments: Details of any recurring payments you have set up from your account.

Decoding Your Transaction History: Uncovering Financial Patterns and Trends

One of the most valuable aspects of your bank statement is the ability to analyze your spending patterns. By carefully examining your transaction history, you can discover recurring trends that might reveal areas where you can save money or adjust your financial habits.

1. Categorize Your Spending: Track Where Your Money Goes

Start by categorizing your spending into meaningful groups. This can help you understand where your money is going and identify opportunities for making smarter financial decisions. Here are some common categories to consider:

- Housing: Rent, mortgage payments, property taxes, insurance.

- Food: Groceries, dining out, takeout.

- Transportation: Car payments, gas, public transportation, parking.

- Utilities: Electricity, gas, water, internet, phone.

- Entertainment: Movies, concerts, sporting events, travel.

- Shopping: Clothing, electronics, personal care items.

- Subscriptions: Streaming services, online memberships, gym memberships.

- Medical: Doctor visits, prescriptions, dental care.

- Personal care: Haircuts, massages, beauty products.

- Gifts: Birthday gifts, holiday gifts, special occasions.

- Savings: Contributions to savings accounts or retirement funds.

2. Identify Recurring Spending: Spot Opportunities to Save

Once you’ve categorized your spending, you can easily spot recurring expenses. Take a closer look at these recurring payments and see if you can:

- Negotiate lower rates: Many service providers are open to negotiating lower rates, especially if you’re a loyal customer.

- Cancel unused subscriptions: Do you pay for streaming services you no longer use? Cut those expenses immediately.

- Shop around for better deals: Compare prices for services or products before you commit to a purchase.

- Automate your savings: Set up automatic transfers to your savings account to make saving a habit.

3. Track Your Progress: Monitor Your Financial Health

Regularly reviewing your bank statement is an excellent way to monitor your financial progress. Track your spending over time and see if you’re meeting your financial goals. Adjust your budget or spending habits as needed to stay on track.

Leveraging Your Bank of America Bank Statement for Financial Success

Your Bank of America bank statement is a powerful tool to enhance your financial journey. By understanding the information it provides and using it to your advantage, you can unlock financial possibilities and build a brighter financial future.

1. Create a Budget: Take Control of Your Finances

Use the information from your statement to create a budget that reflects your actual spending habits. Allocate your income to different categories based on your financial priorities. This will help you stay within your budget, avoid unnecessary expenses, and work towards achieving your financial goals.

2. Set Financial Goals: Define Your Financial Aspirations

What are your financial aspirations? Do you want to buy a house, travel the world, retire early, or start a business? Use your bank statement to stay motivated and track your progress towards your financial goals. By analyzing your spending patterns and making necessary adjustments, you can achieve even the most ambitious financial dreams.

3. Monitor Your Finances: Stay Proactive with Your Financial Health

Review your bank statement regularly to ensure that your spending is aligned with your financial goals. Monitor your account for any unauthorized transactions or suspicious activity. By staying proactive, you can quickly identify and address any financial issues before they become bigger problems.

Expert Insights: Tips from Financial Professionals

Here are some additional tips from experienced financial professionals to help you maximize the value of your Bank of America bank statement:

- Use online banking tools: Bank of America offers a variety of online banking tools and features that can help you manage your money more effectively. Take advantage of these tools to track your spending, set up budgeting categories, and manage your account with ease.

- Set up alerts and notifications: Set up alerts for important transactions, such as large purchases, low account balances, or suspicious activity. This can help you stay on top of your finances and address any potential issues promptly.

- Review your credit report: Your bank statement can help you understand your spending habits, which can, in turn, affect your credit score. Review your credit report regularly to ensure that your spending patterns are not negatively impacting your credit score.

- Contact Bank of America customer service: If you have any questions about your bank statement or need assistance with your account, don’t hesitate to contact Bank of America customer service. They are there to help you navigate the statement and answer any of your financial questions.

Bank Of America Bank Statement 2022

Conclusion: Empowering Your Financial Journey

Navigating your Bank of America bank statement can seem daunting at first, but with a little effort, it can become a powerful tool to enhance your financial well-being. Gain a comprehensive understanding of your statement, analyze your spending patterns, track your progress towards your goals, and utilize the various online banking tools available to you. By taking control of your finances, you can make informed decisions about your money and unlock a brighter financial future.