Have you ever wondered how seasoned traders seem to effortlessly predict market movements, consistently turning profits? The answer lies in the art of “price action trading,” a method that relies on understanding the raw language of the market – the price itself. While technical indicators and complex analysis have their place, price action trading offers a clean and potent approach to navigating the financial world. This comprehensive guide dives into the fundamental concepts, revealing secrets that will empower you to decipher market signals and potentially make informed trading decisions.

Image: www.cmcmarkets.com

In the dynamic realm of trading, where fortunes can be built and lost within a blink of an eye, it’s imperative to possess a toolkit that allows you to navigate the market with precision. Price action trading, a technique that leverages price movements and candlestick patterns to identify trading opportunities, has emerged as a popular strategy for traders of all levels. 2021 witnessed a surge in interest surrounding this method, with traders seeking a more intuitive and straightforward way to decode market sentiment. This guide aims to unravel the intricacies of price action trading, revealing the secrets that can help you gain an edge in the financial markets.

The Essence of Price Action Trading

Price action trading revolves around the core principle that the market’s behavior is best reflected in the price itself, rather than relying on external tools or indicators. Imagine the price of a stock as a storyteller, conveying its narrative through a series of highs, lows, and dips. Candlestick patterns, those distinct shapes that represent price fluctuations over a set time period, act as chapters in this story. By understanding the language of these patterns, traders can decipher market sentiment and potentially anticipate future price movements.

The Crucial Pillars of Price Action Trading

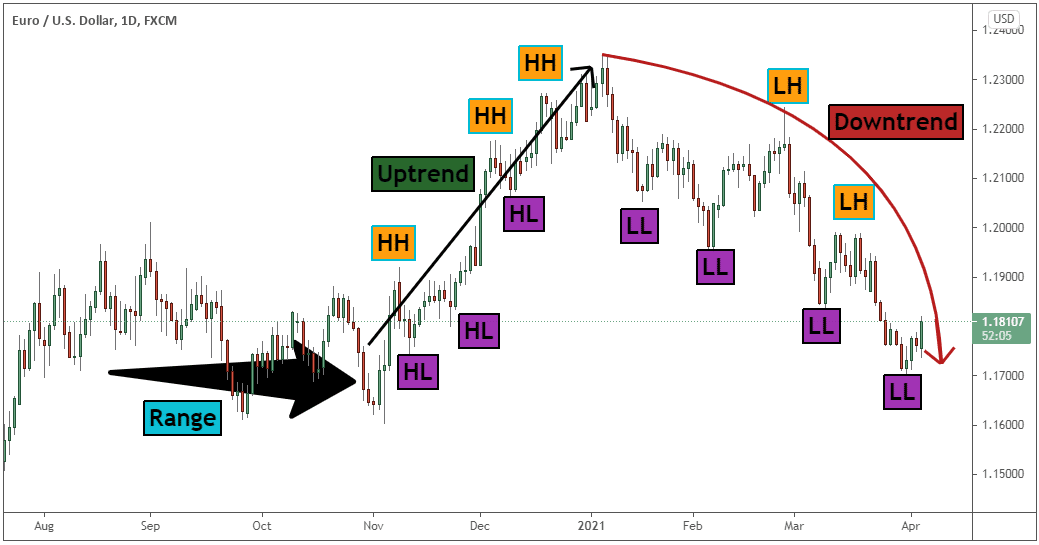

Understanding Chart Patterns

Price action strategies are built on recognizing recurring patterns in price charts. These patterns, such as bullish and bearish engulfing patterns, head-and-shoulders formations, and double tops/bottoms, offer visual cues about potential price reversals and continuations. Mastering the identification and interpretation of these patterns is crucial for maximizing the effectiveness of price action trading.

Image: tradingstrategyguides.com

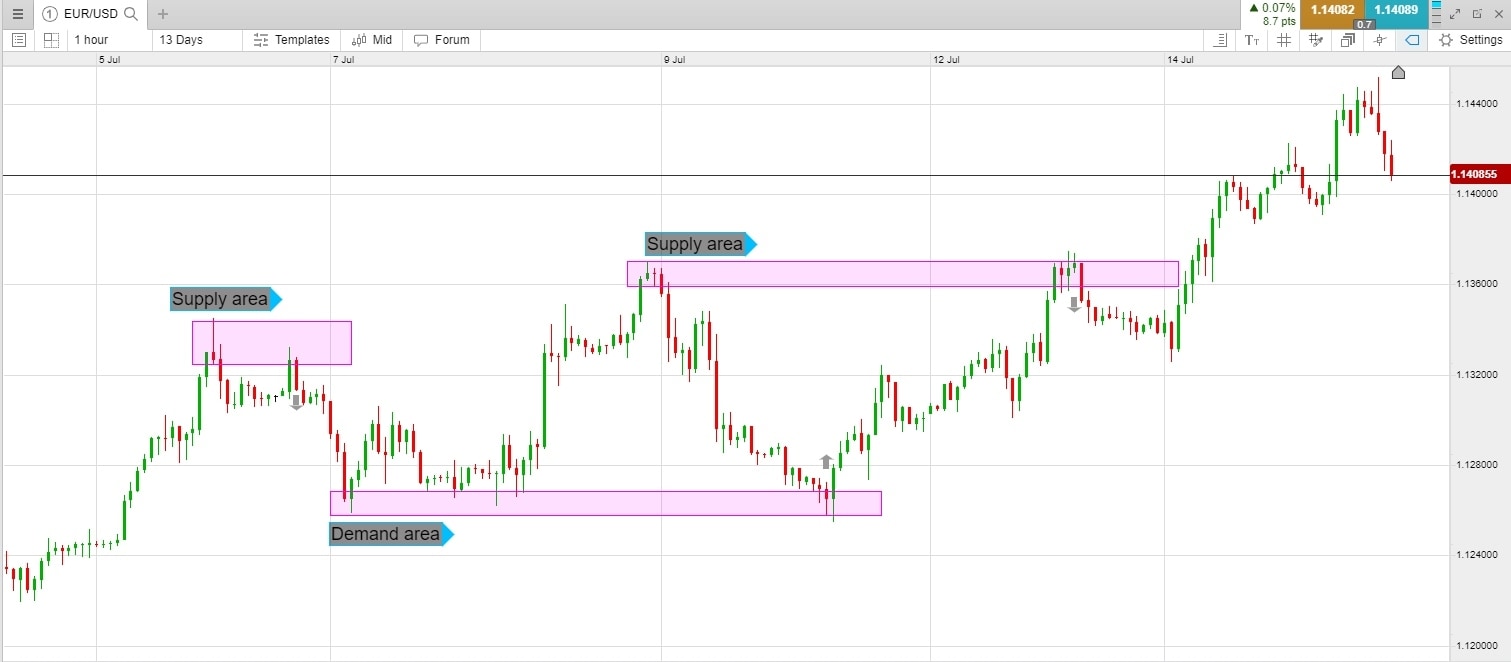

Recognizing Support and Resistance Levels

Support and resistance levels are essential components of price action analysis. Support levels mark areas where the price is likely to find buying interest, while resistance levels represent areas where price encounters selling pressure. These levels serve as valuable indicators for potential price reversals or consolidation zones. Identifying and interpreting these levels is crucial for informed trading decisions.

The Power of Candlestick Patterns

Candlesticks, those visually appealing representations of price movements over a specific time period, are the heart of price action trading. Each candlestick embodies a rich narrative, offering insights into the intensity of buyers and sellers during a particular timeframe. Understanding candlestick patterns such as the engulfing pattern, the doji, the morning star, and the evening star allows traders to decipher market sentiment and anticipate potential price movements.

Decoding the Language of Candlesticks

The Engulfing Pattern

The engulfing pattern is a powerful candlestick pattern that signals a potential reversal in price direction. It consists of a large candlestick, either bullish or bearish, that “engulfs” the previous candlestick. This suggests that the buying or selling pressure that created the engulfing candlestick is likely to dominate the market in the near future.

The Doji

The doji is a candlestick pattern characterized by an open and close price that are virtually identical, creating a small, almost horizontal line. Doji patterns often signal indecision in the market, indicating a balance between buyers and sellers. This indecision could lead to a change in price direction, making it a valuable pattern for trend reversals.

Practical Applications: Putting Price Action Trading into Action

Developing a Trading Plan

Effective price action trading begins with a well-defined trading plan. This plan should outline your entry and exit strategies, risk management approach, and profit targets. Stick to your plan consistently, even when emotions run high, to ensure disciplined trading practices.

Utilizing Stop Losses

Risk management is paramount in trading, and stop-loss orders are your safety net. Stop-loss orders automatically exit your position when the price reaches a predetermined unfavorable level, limiting potential losses.

Choosing the Right Timeframes

Price action trading can be applied to various timeframes, but it’s essential to select the right one for your trading style and risk profile. Short-term traders may focus on 5-minute or 15-minute charts, while longer-term traders might opt for daily or weekly charts.

The Evolution of Price Action Trading: Trends for 2021

Price action trading continues to evolve alongside technological advancements and changing market dynamics. In 2021, several key trends emerged, reflecting a growing emphasis on automation and data-driven strategies.

Trading Algorithms: Automating Price Action Strategies

AI and machine learning are increasingly being employed to automate price action trading strategies. These algorithms can analyze vast amounts of data in real-time, identifying patterns and executing trades with lightning speed. This automation removes human emotions and biases, leading to more disciplined trading decisions.

Sentiment Analysis and Social Media Monitoring

The growing influence of social media and online platforms on market sentiment has led to the development of sentiment analysis tools. These tools analyze comments, posts, and news articles to gauge overall market sentiment, providing traders with valuable insights into potential price movements.

Price Action Trading Secrets 2021 Pdf

Conclusion: Embark on Your Price Action Journey

Price action trading offers a potent and intuitive approach to navigating the financial markets. By mastering the language of price movements, candlestick patterns, and support/resistance levels, you can decipher market signals and potentially capitalize on trading opportunities. Remember, success in trading, like any skill, requires dedication, practice, and continuous learning. This guide serves as a starting point on your price action journey. As you delve deeper into this world, you’ll uncover the intricacies of this powerful and often revealing method of trading.