Have you ever wondered about the intricate world of legal exemptions and how they impact your assets? The concept of “accept for value” (AFV) has sparked debate and curiosity, suggesting that certain transactions can potentially shield assets from levies, including those stemming from lawsuits or tax obligations. While the idea might sound intriguing, navigating this complex area requires careful consideration and a thorough understanding of the nuances involved.

Image: www.slideserve.com

This article delves into the intricacies of “accept for value” exempt from levy, exploring its origins, its use in specific contexts, and its potential pitfalls. We aim to empower you with the knowledge to discern fact from fiction and make informed decisions regarding your financial security.

Defining “Accept for Value”

The term “accept for value” generally refers to a legal theory that proposes a debt can be extinguished if it’s exchanged for a “thing of value” other than legal tender or currency. This exchange typically involves tangible assets like gold or silver, or even intangible assets like intellectual property rights. proponents of AFV suggest that by accepting these alternative forms of payment, they effectively “release” the original debt, making it unenforceable by creditors.

Historical Roots and Legal Recognition

The roots of the AFV concept can be traced back to ancient legal principles of “payment by barter” and the concept of “consideration” in contract law. Historically, societies often relied on bartering goods and services for a mutual exchange, providing a foundation for the idea of value beyond traditional currency.

However, with the advent of centralized monetary systems and standardized legal frameworks, the acceptance of alternative forms of payment became more circumscribed. Most modern legal systems prioritize cash or recognized legal tender as the primary means of financial transactions.

AFV and its Applications

Despite its historical roots, “accept for value” as a legal doctrine has gained prominence mainly in certain fringe legal communities. Advocates argue that it can serve as a means of protecting assets from government levies or predatory creditors. For example:

- Tax Avoidance: Some proponents recommend using AFV to potentially avoid tax liabilities. They suggest that by accepting alternative forms of payment for tax obligations, taxpayers could “circumvent” the traditional system and possibly reduce their tax burden.

- Debt Settlement: Another application focuses on potentially settling debts outside of traditional legal channels. By offering an alternative asset or form of payment, debtors may try to negotiate a debt release, circumventing further legal action.

Image: www.dinardaily.net

Debunking the Myths: Why “Accept for Value” May Not Work

While the theory of AFV might seem appealing, it faces considerable legal and practical challenges. It’s crucial to understand that legal systems in most countries adhere to established procedures for financial transactions and debt settlement.

Here are some key points to consider:

- Lack of Broad Legal Recognition: “Accept for value” as a stand-alone exemption from levy lacks widespread recognition and acceptance in most established legal jurisdictions. While certain legal precedents might incorporate elements of barter or “consideration,” they usually apply in specific contexts and don’t offer blanket protection against levies.

- Challenges in Enforcement: Even if a party claims to have accepted an alternative form of payment, it’s often difficult to prove that the exchange was legally valid and fully extinguished the original debt. Courts generally favor formal documentation for financial transactions, making it challenging to rely solely on “accept for value” as a defense against creditors.

- Potential for Abuse: The concept of AFV is susceptible to abuse, particularly by individuals who might try to circumvent their financial obligations or manipulate the system. This can lead to legal complications, court battles, and potentially even criminal charges.

Navigating the Complexities: Seeking Professional Advice

Given the complexities surrounding “accept for value,” it’s highly advisable to consult with legal and financial professionals before entertaining any transaction that relies on this concept. These individuals possess the expertise to assess the specific legal landscape and provide informed guidance on your financial options.

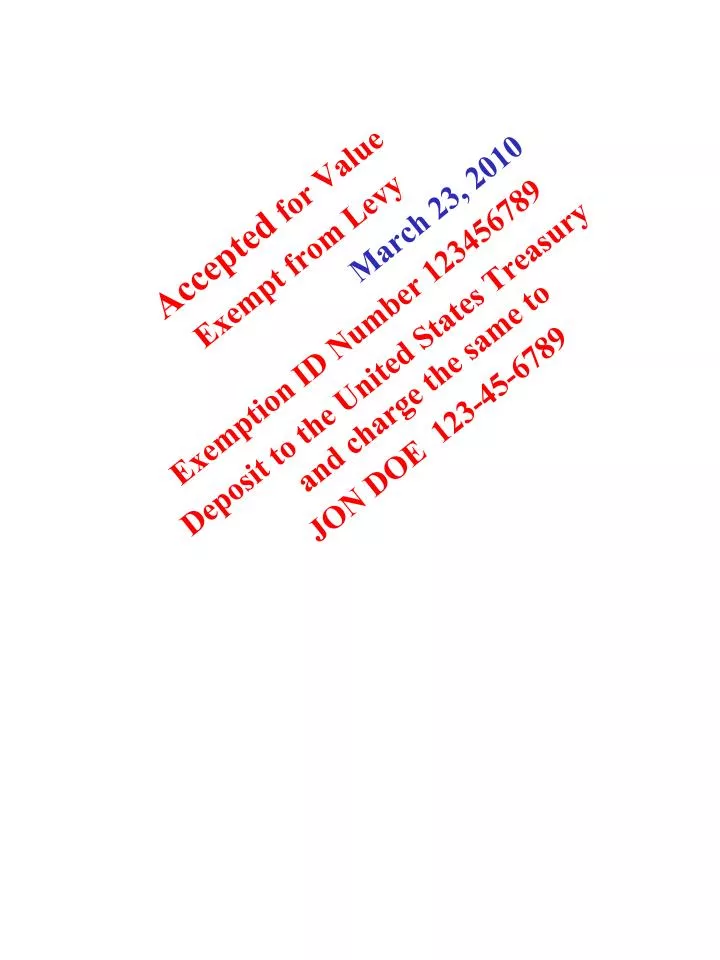

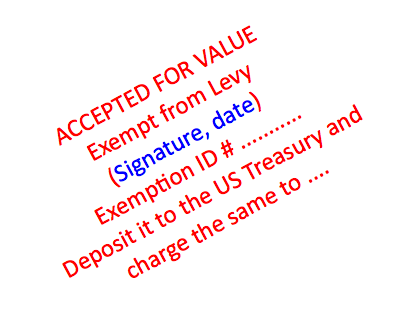

Accept For Value Exempt From Levy

Moving Forward: Understanding Your Options

While “accept for value” remains a contentious and often misunderstood doctrine, understanding its limitations and potential pitfalls is crucial. It’s important to remember that safeguarding your assets requires a comprehensive approach that involves adherence to legal requirements, proper financial planning, and seeking professional advice when necessary.

As we have highlighted, the concept of AFV is a complex legal area with significant potential risks. Rather than relying on potentially questionable strategies, focus on establishing transparent and legally sound financial practices that will protect your interests and provide long-term stability and security.