Imagine this: You’ve diligently recorded a deposit made by a customer in your accounting software, confident that your recordkeeping is up-to-date. However, the bank statement arrives, and your carefully prepared balance doesn’t match. This discrepancy can be nerve-wracking, especially when you’re trying to keep track of your cash flow. The culprit? A deposit in transit, a common accounting phenomenon that often leads to confusion.

Image: www.youtube.com

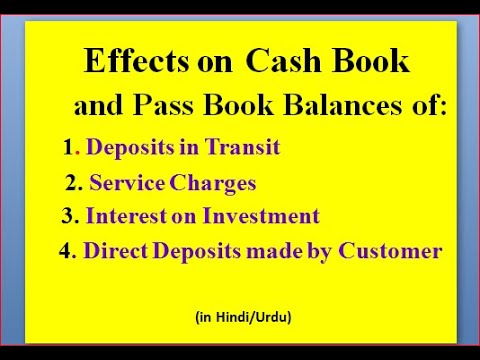

This article will guide you through the intricacies of computing deposit in transit, demystifying the process and equipping you with the knowledge to maintain accurate financial records. We’ll delve into various aspects of this crucial concept, including its definition, real-world applications, and best practices for computation, ensuring you navigate this aspect of accounting with confidence.

Understanding Deposits in Transit

What are Deposits in Transit?

A deposit in transit represents a deposit that has been recorded by a business in its accounting records but has yet to be reflected in the bank’s records. It occurs when a business deposits funds into its bank account, but the bank hasn’t yet processed the transaction.

Think of it as a temporary state of limbo. The business sees the deposit in its own accounting system, but the bank hasn’t updated its records yet. This often happens due to timing differences, as banks typically take a few days to process transactions, especially those received near the end of the banking day.

The Importance of Computing Deposits in Transit

Calculating deposits in transit is crucial because it ensures that your bank reconciliation, a vital process that verifies the accuracy of your financial records, is accurate. This process involves comparing your company’s records to the bank’s statement. Any discrepancies between your records and the bank’s records need to be explained.

Deposits in transit are one of the reconciling items that bridge the gap between the two records. Failing to account for them can result in inaccurate financial statements, potentially leading to incorrect cash flow estimates, forecasting errors, and flawed financial decisions.

Image: investors.wiki

Methods for Computing Deposit in Transit

Step 1: Identify Deposits Recorded but Not Yet Processed

Start by reviewing your company’s cash receipts journal or any equivalent record-keeping system that captures all deposits made. Identify any deposit entries that have been recorded but aren’t yet reflected on your most recent bank statement.

Step 2: Reconcile with the Bank Statement

Compare the deposits from your records to the bank statement. If a deposit is recorded in your system but not listed on the statement, you’ve identified a deposit in transit.

Step 3: Calculate the Amount

Once you’ve identified deposits in transit, calculate their total amount. This total amount represents the difference between the balance per your books and the balance per the bank statement, which needs to be adjusted accordingly.

Tips and Expert Advice

Here are some tips to ensure you compute deposits in transit accurately and minimize any discrepancies:

- Timely Deposits: Aim to make deposits early in the banking day to reduce processing time and the likelihood of deposits being in transit at the end of the month.

- Electronic Deposits: Consider electronic deposit methods like ACH transfers, which are usually processed more quickly, reducing the time a deposit remains in transit.

- Regular Reconciliations: Performing bank reconciliations regularly, ideally at the end of each month, helps identify deposits in transit and reconcile differences promptly. This practice minimizes the chance of major discrepancies.

- Use a Spreadsheet: Create a simple spreadsheet to track deposits in transit. It can be incredibly helpful for maintaining clear records, especially when dealing with multiple deposits.

By diligently following these tips, you can streamline your accounting processes, minimizing the occurrences of deposits in transit and ensuring accurate financial reporting.

FAQ on Deposit in Transit

Q: What if a deposit appears on the bank statement but not in my records?

If a deposit appears on the bank statement but is not in your company’s accounting records, you may be dealing with a situation where a deposit was made directly by a customer into your bank account without your direct involvement. In this case, you’ll need to investigate the source of the deposit and reconcile it with your records.

Q: Is there a specific timeframe for deposits to clear?

The timeframe for deposits to clear depends primarily on the method of deposit and the bank’s policies. For example, cash deposits might take longer to process than electronic transfers. Typically, most bank deposits clear within 1-3 business days. However, it’s best to check with your bank for their specific processing times.

Q: Can a deposit in transit affect my company’s cash flow?

Yes, deposits in transit can temporarily affect your company’s cash flow. Since the money hasn’t yet cleared your bank account, it’s not immediately available for spending. However, by diligently tracking deposits in transit and using effective cash flow management techniques, you can anticipate these temporary restrictions and maintain adequate liquidity.

How To Compute Deposit In Transit

Conclusion

Understanding the concept of deposits in transit is vital for accurately tracking your company’s cash flows. When you diligently calculate and reconcile deposits in transit, you gain a clear picture of your actual financial position and make informed financial decisions. By following the tips and incorporating best practices we’ve shared, you can significantly reduce the complexities associated with this common accounting scenario.

Are you interested in learning more about accounting best practices, especially those related to bank reconciliations and managing your cash flow? Please let us know in the comments below, and we’ll be happy to provide additional insights.