Have you ever wondered what goes into securing a commercial space for your business? Beyond the excitement of finding the perfect location, there’s a crucial step often overlooked: signing a lease agreement. This document outlines the terms and conditions of your tenancy, determining your rights and responsibilities for the duration of the agreement. A well-crafted lease can be a powerful tool, safeguarding your business interests and ensuring a smooth operating environment. In this comprehensive guide, we’ll explore the essential elements of a sample commercial lease agreement, demystifying the legal jargon and empowering you to make informed decisions.

Image: templates.rjuuc.edu.np

Understanding the intricacies of a commercial lease agreement is vital for any business owner or prospective tenant. It can impact your financial obligations, operational flexibility, and overall business success. From rent payments and maintenance responsibilities to the duration of the lease and potential renewal options, a robust lease agreement serves as a blueprint for your commercial tenancy. By navigating its provisions confidently, you can establish a solid foundation for your business growth and minimize potential disputes or conflicts later on.

The Basics: Unveiling the Blueprint

Who are the parties?

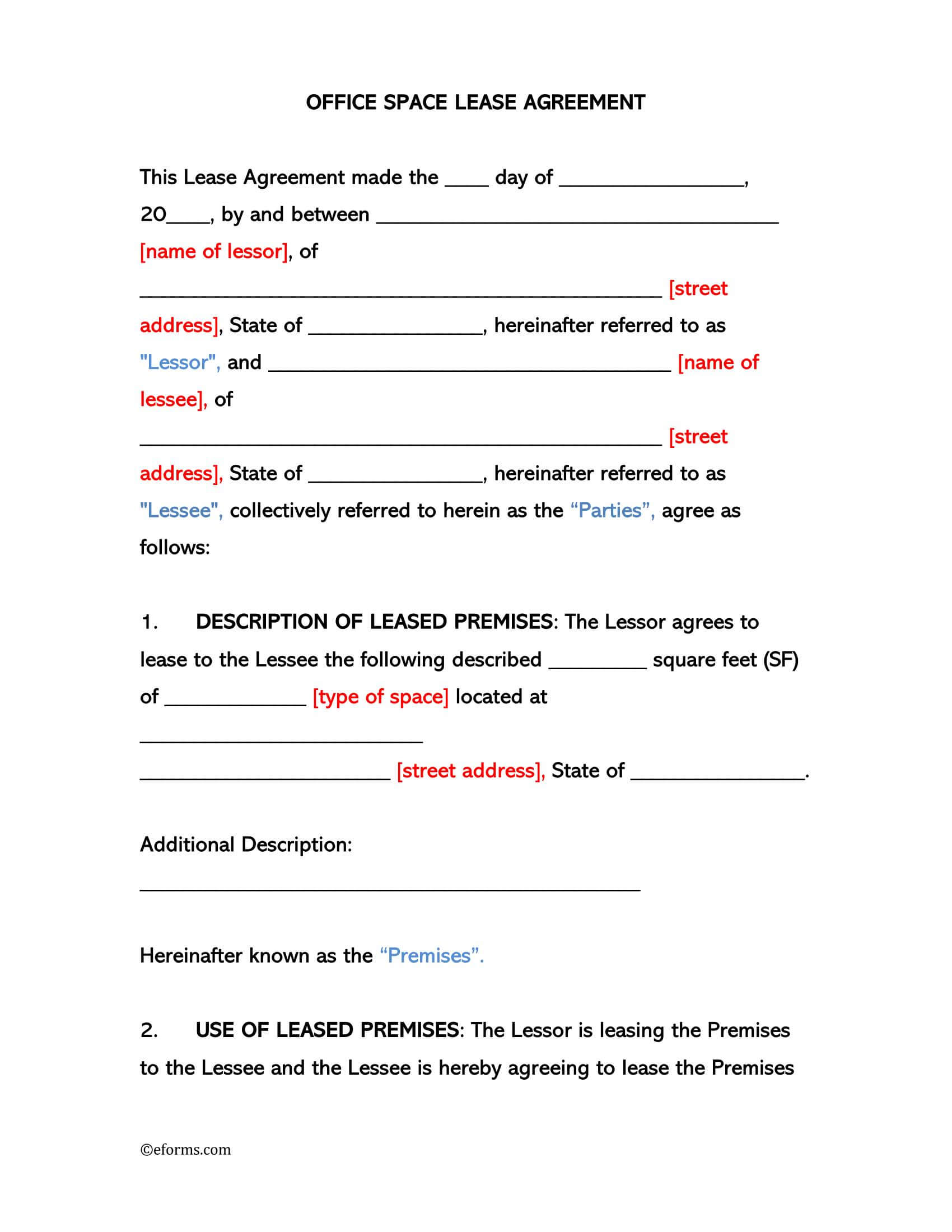

At the heart of any lease agreement are the two key parties: the lessor (also known as the landlord) and the lessee (the tenant). The lessor owns the property and grants the lessee the right to occupy and use the premises for a specified period. This relationship is formalized in writing, outlining the terms and conditions that both parties agree to abide by.

Defining the premises: Location, location, location

The lease agreement meticulously describes the commercial space being leased. This includes the specific address, unit number, and square footage. Additionally, it might specify the inclusion of any shared areas, such as hallways or parking lots. It’s crucial to ensure that the description aligns precisely with your business needs and expectations. If any discrepancies exist, address them promptly to avoid future misunderstandings.

Image: templates.rjuuc.edu.np

The Lease Term: A Timeframe for Growth

A critical element is the lease term, defining the duration of the agreement. This is typically expressed in years, and it determines the period during which the lessee has the right to occupy the premises. Consider factors like your business’s projected growth, market conditions, and your long-term strategy when determining the appropriate lease term. It’s worth noting that most commercial leases contain renewal options or provisions for potential extensions, providing flexibility in case your business needs evolve.

The Financial Framework: Rent, Deposits, and Obligations

Rent: The Foundation of Occupancy

The lease agreement clearly stipulates the rent amount, outlining how much the lessee will pay to the lessor for occupying the space. This could be a fixed monthly amount, or it could be structured as a percentage of the lessee’s gross sales (referred to as a percentage rent). The rent may also include specific charges for utilities, common area maintenance, or property taxes. Additionally, the lease will specify the rent payment schedule, outlining due dates and acceptable payment methods.

Security Deposits: Protecting the Lessor’s Interests

A security deposit is often required by the lessor as a safeguard against potential damages or non-payment of rent. This deposit is usually returned to the lessee upon the termination of the lease, provided that no deductions are necessary for any property restoration or unpaid rent obligations. The lease agreement outlines the terms and conditions surrounding the security deposit, including the amount, how it’s held, and under what circumstances it can be used.

Beyond Rent: Additional Expenses

Commercially leased spaces often include additional expenses beyond the base rent. These can encompass utilities like water, electricity, and gas, as well as property taxes and insurance premiums. The lease may specify whether the lessee or the lessor is responsible for paying these expenses, or it may outline a shared responsibility arrangement. Understanding these charges is vital for accurately budgeting your operational costs.

Operational Flexibility: Use and Restrictions

Allowed Use: Tailored for Your Business

A crucial aspect of any commercial lease agreement is the allowed use clause. This specifies the permitted activities within the leased space. It’s crucial to ensure that your business operations align with the designated allowed use. Modifications to the lease agreement may be required if your business plans involve activities not initially covered. This clause ensures a harmonious relationship with the lessor and neighboring tenants, preventing any unexpected conflicts or disruptions.

Restrictions: Maintaining Harmony

Commercial leases often include restrictions that govern the tenant’s activities. These might include limitations on noise levels, operating hours, alterations to the premises, or the display of signage. It’s essential to carefully review these restrictions to avoid any unintentional violations. These provisions are in place to ensure a balanced environment conducive to both business operations and community harmony.

Navigating Maintenance and Repairs

Shared Responsibilities: A Partnership in Upkeep

Commercial lease agreements typically outline the responsibilities for maintaining the leased premises. This encompasses both interior and exterior upkeep. The lease will define which party is responsible for specific maintenance tasks, such as repairing plumbing issues, handling landscaping, or addressing structural concerns. It’s crucial to understand these responsibilities to ensure that the property remains in good condition and avoid any disputes over repairs or maintenance costs.

Alterations: Transforming the Space

If your business requires modifications to the leased premises, the lease agreement will address alterations. This clause details any necessary permits or approvals, as well as the tenant’s responsibility for restoring the property to its original condition upon lease termination. It might also outline the potential for reimbursement or compensation for approved improvements made by the tenant.

Termination and Renewal: Securing Your Future

Lease Termination: Understanding the Exit Strategy

Commercial lease agreements define the conditions under which a lease may be terminated. These can include a specified expiration date, a notice period required to end the agreement, or specific circumstances that allow for early termination, like a breach of contract by either party. It’s important to be aware of these provisions to ensure a smooth transition and avoid any potential complications when it’s time to move out.

Renewal Options: Planning for the Future

Many commercial leases include renewal options, giving the lessee the right to extend the lease for a predetermined period under specific terms. These options offer valuable security for your business and can be a key factor in long-term planning. Understanding the renewal process and any associated terms, such as rent adjustments or potential changes to the lease agreement, is essential for securing your business’s future within the leased space.

Additional Considerations: A Deeper Dive

Insurance: Protecting Your Investment

The lease agreement likely requires the lessee to obtain adequate insurance coverage to protect both the property and the business. This might include general liability insurance, property insurance, and worker’s compensation insurance, depending on the nature of your business operations. The lease will specify the types of insurance required, the levels of coverage, and the insurer’s requirements for providing proof of insurance.

Default and Remedies: Managing Potential Issues

Commercial leases often outline default scenarios, detailing the consequences for breaches of the lease agreement by either party. This could include failure to pay rent, violation of permitted use, or failure to maintain the premises. The lease will specify the remedies available to the non-defaulting party, which may include financial penalties, termination of the lease, or legal action.

Governing Law and Dispute Resolution: A Framework for Resolution

The lease agreement typically designates the governing law that will be applied in the event of any disputes. This typically aligns with the state laws where the property is located. Additionally, the lease may outline a specific dispute resolution process, potentially involving mediation or arbitration, to resolve any disagreements that may arise.

Navigating the Legal Labyrinth: Seeking Professional Guidance

A commercial lease agreement is a complex legal document that requires careful attention and thorough understanding. While this guide provides a basic overview, it’s highly recommended that you consult with an experienced real estate attorney before signing any lease agreement. An attorney can review the document, explain the legal nuances, and advocate for your best interests. Their expertise can protect you from potential pitfalls and ensure that the lease agreement is fair, comprehensive, and beneficial to your business.

Sample Contract Of Lease For Commercial Space

Conclusion: Embarking on Secure Tenancy

Securing a commercial lease agreement is a crucial step in establishing your business. It’s a legal contract that defines your relationship with the property owner and outlines your rights and responsibilities for occupying the space. By understanding the essential elements of a sample lease agreement, you can navigate this process confidently, ensuring that your business interests are adequately protected. Remember, seeking professional legal advice is highly recommended to make informed decisions and avoid any potential pitfalls. With a well-crafted lease agreement in hand, you can focus on creating a successful and thriving business within your leased space.