Imagine a world where the weight of past financial mistakes no longer weighs you down. Where you can walk into a car dealership or apply for a mortgage with confidence, knowing your credit history doesn’t hold you back. This dream, once seemingly out of reach, can become a reality by removing dismissed bankruptcies from your credit report. This guide will empower you with the knowledge and tools to navigate this journey, reclaiming your financial freedom.

Image: creditwalls.blogspot.com

A dismissed bankruptcy, though legally discharged, can stubbornly linger on your credit report, casting a shadow over your financial future. These lingering marks can act as barriers to your financial goals, making it difficult to secure loans, mortgages, or even rent an apartment. But fear not, as there are legal and effective ways to remove these outdated entries and pave the way for a brighter financial future.

Understanding the Power of a Clean Credit Report

Your credit report is a detailed record of your borrowing and repayment history, serving as a financial blueprint that lenders use to assess your creditworthiness. It’s a scorecard that influences everything from loan interest rates to insurance premiums. A clean credit report, free from outdated or inaccurate information, is the key to unlocking better financial opportunities.

Why Dismissed Bankruptcies Remain on Your Credit Report

The Fair Credit Reporting Act (FCRA) governs how credit bureaus collect, use, and disseminate information. While it dictates how long certain negative information can remain on your report, dismissed bankruptcies haven’t always fallen under these specific guidelines. In the past, credit bureaus often treated dismissed bankruptcies as legitimate negative marks, despite their legal dismissal.

Challenging the Accuracy of Your Credit Report

The cornerstone to removing dismissed bankruptcies from your credit report lies in challenging their accuracy with the credit bureaus. This process, known as a “credit dispute,” involves submitting a formal request to the relevant credit bureaus – Experian, Equifax, and TransUnion – disputing the information’s accuracy and requesting its removal.

Image: www.pinterest.com

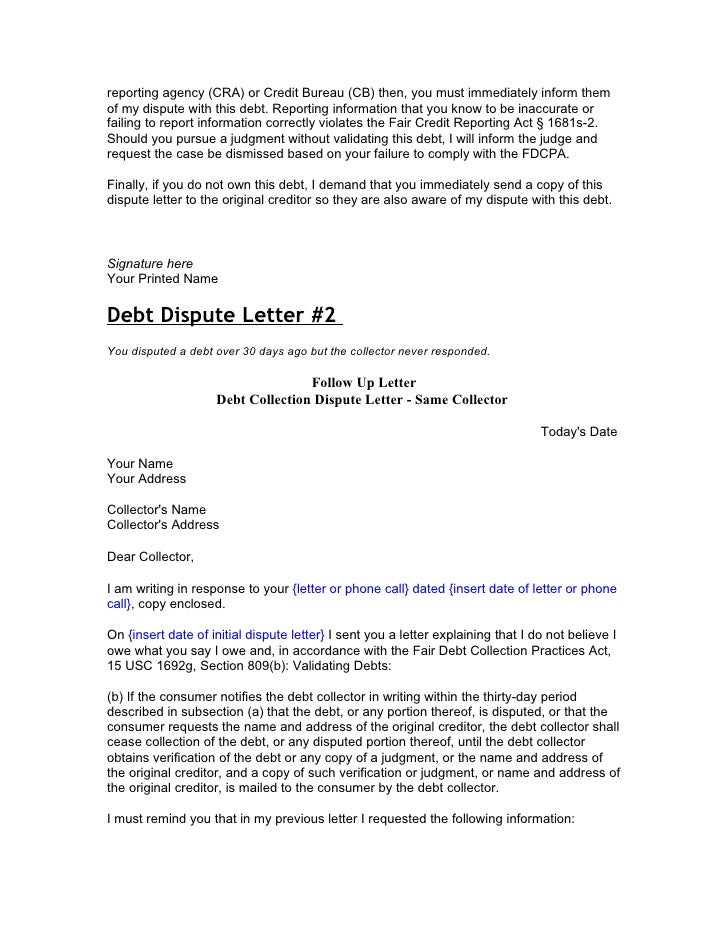

Composing a Powerful Credit Dispute Letter

Crafting a compelling credit dispute letter is crucial. It must clearly and concisely state your case, demonstrating the accuracy error and highlighting the dismissed bankruptcy status. Here’s a sample letter framework you can use as inspiration:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Name of Credit Bureau]

[Address of Credit Bureau]

RE: Dispute of Dismissed Bankruptcy on Credit Report

Dear [Name of Credit Bureau],

I am writing to formally dispute the accuracy of my credit report, account number [account number], which erroneously lists a dismissed bankruptcy. I was granted a discharge of my Chapter [7/13] bankruptcy on [date] by the U.S. Bankruptcy Court for the [district] District of [state], case number [case number]. The bankruptcy was dismissed and closed on [date].

I am requesting that you investigate the accuracy of this information and remove it from my credit report. I have attached a copy of my bankruptcy discharge order as proof of dismissal. You can also verify this information with the U.S. Bankruptcy Court at [phone number] or through their website at [website address].

Thank you for your prompt attention to this matter. I look forward to hearing from you regarding the outcome of my dispute.

Sincerely,

[Your Signature]

[Your Typed Name]

Remember to personalize the letter with your specific details and relevant documentation to strengthen your argument. Be sure to submit a separate copy of the letter to each credit bureau.

Leveraging Documentation to Strengthen Your Case

Documentation is your strongest ally in this process. The more concrete evidence you can provide, the more likely the credit bureaus will acknowledge the dismissed bankruptcy’s inaccuracy. Gather these essential documents to support your credit dispute:

- Bankruptcy Discharge Order: This official document from the bankruptcy court is the cornerstone of your argument. It proves that the bankruptcy was dismissed, rendering the entry on your credit report inaccurate.

- Court Case File Number: Include this number for easier verification by the credit bureau. This number can be found on the bankruptcy discharge order.

- Copy of Your Credit Report: Highlight the specific entry you are disputing within your copy of the report to ensure clarity and efficiency.

Navigating the Credit Dispute Process

Once you’ve sent your dispute letters, the credit bureaus will investigate and respond within 30 days. They may verify the information with the source of the entry (usually the bankruptcy court) or provide an explanation for their decision. If they find the information inaccurate, they will correct it and remove the dismissed bankruptcy from your credit report. If they maintain the entry’s accuracy, you can appeal their decision.

The Path Forward: Rebuilding Your Credit

Removing dismissed bankruptcies is a significant step in rebuilding your credit. It opens doors to better financial opportunities and paves the way for a brighter financial future. The process may require persistence and patience, but the rewards are well worth the effort. This newfound financial freedom allows you to confidently apply for loans, mortgages, and other financial products, enabling you to accomplish your dreams and reach your full financial potential.

Sample Letter To Removing Dismissed Bankruptcies Credit Report

Conclusion

Removing dismissed bankruptcies from your credit report is a powerful step towards reclaiming your financial future. By taking the initiative to dispute inaccuracies and leveraging the power of documentation, you can clear your credit history and enhance your financial well-being. Remember, achieving this goal often requires persistence and patience, but the benefits of a clean credit report will open doors to a brighter financial tomorrow. Explore additional resources and seek professional advice if needed to navigate this journey effectively, and embrace the opportunity to rewrite your financial narrative.