The journey to financial freedom can feel daunting, especially when you’re just starting out. But with the right tools and guidance, anyone can take control of their finances and build a secure future. That’s where the Ramsey Classroom comes in, offering valuable lessons on budgeting, saving, debt management, and investing. In this article, we’ll delve into Chapter 10, Lesson 2, focusing on the practical activities that help solidify your understanding of smart money management.

Image: maximilian-has-douglas.blogspot.com

As someone who has personally navigated the highs and lows of personal finance, I can attest to the transformative power of education and action. The Ramsey Classroom Chapter 10, Lesson 2 activities challenged me to think critically about my spending habits and develop a realistic plan for reaching my financial goals. This shift in my approach to money has led to greater peace of mind and a sense of empowerment I never knew before.

Mastering Your Money Mindset

Understanding the Importance of Financial Literacy

Financial literacy is the cornerstone of financial well-being. It encompasses the knowledge, skills, and attitudes necessary to make informed financial decisions. Chapter 10, Lesson 2 emphasizes the importance of developing a positive money mindset. This means shifting your attitude towards money from one of fear and scarcity to one of empowerment and abundance. By adopting a conscious and proactive approach to your finances, you can break free from financial burdens and create a brighter future for yourself and your family.

The Role of Budgeting

At the heart of financial literacy lies the ability to budget effectively. Budgeting involves tracking your income and expenses, identifying areas where you can save, and allocating your funds to meet your financial goals. The Ramsey Classroom Chapter 10, Lesson 2 guides you through the process of creating a realistic budget, encompassing fixed expenses like rent and utilities, variable expenses like groceries and entertainment, and discretionary expenses like dining out and subscriptions. This structured approach helps you gain control of your money and make informed spending decisions.

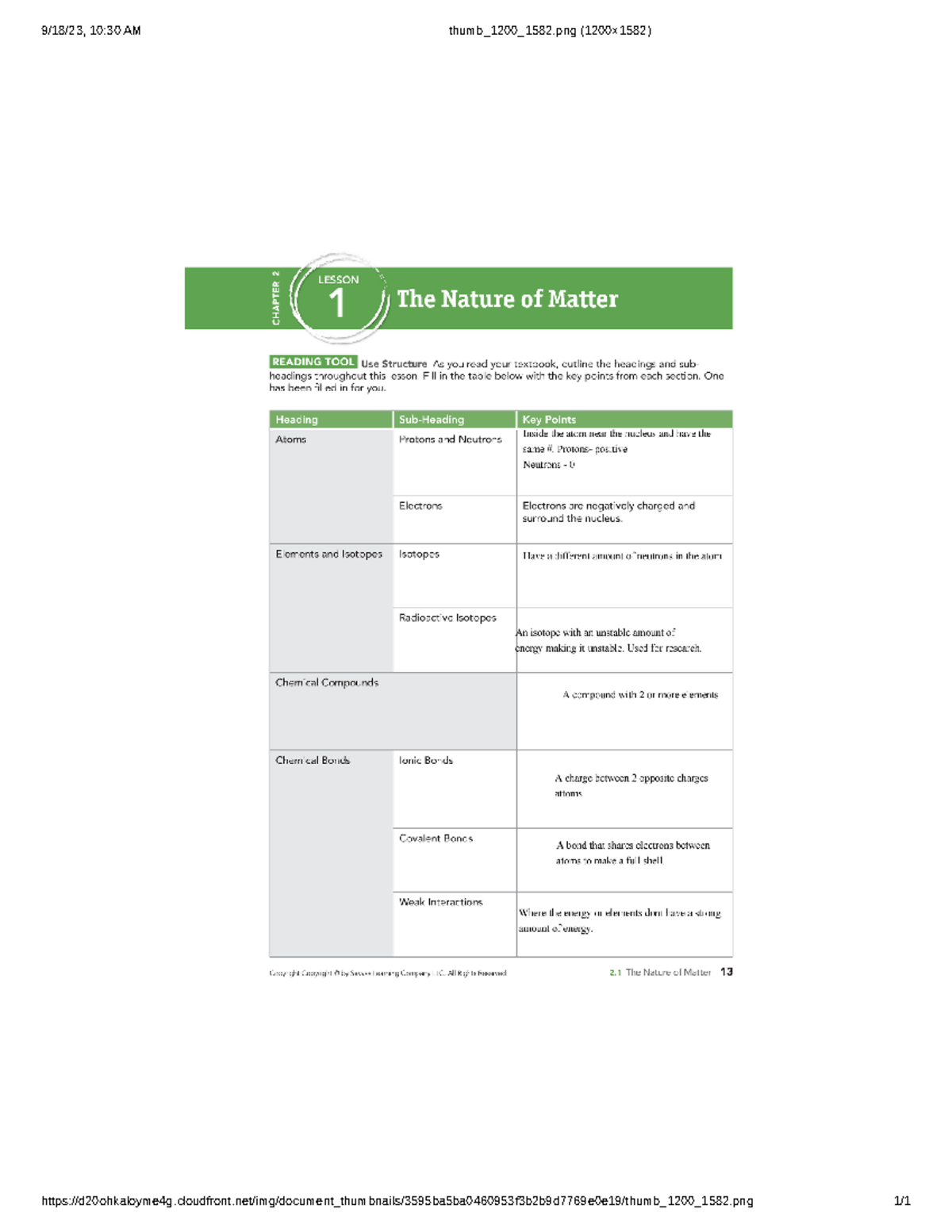

Image: www.studocu.com

Saving for the Future

Saving is a vital component of financial security. It allows you to build an emergency fund, cover unexpected expenses, and pursue long-term financial goals like buying a home or retiring comfortably. This chapter encourages you to set realistic savings goals and develop a savings plan. Whether it’s automating your savings, making small, consistent contributions, or seeking out high-yield savings accounts, the key is to consistently prioritize saving and watch your wealth grow over time.

Navigating the World of Debt

The Impact of Debt on Financial Wellness

Debt can be a major obstacle to financial freedom. It can drain your income, limit your financial flexibility, and prevent you from reaching your goals. This chapter sheds light on the different types of debt, including credit card debt, student loans, and personal loans. It empowers you to understand the consequences of excessive debt and develop strategies for managing your existing debt effectively.

Practical Debt Management Strategies

The Ramsey Classroom Chapter 10, Lesson 2 equips you with practical tools for debt management. The chapter emphasizes the importance of creating a debt snowball, paying off your highest-interest debts first while making minimum payments on the others. This strategy maximizes your debt payoff and helps you regain control of your finances. The chapter also explores the advantages of debt consolidation, where you combine multiple debts into a single loan with a lower interest rate, streamlining your payments and potentially saving money on interest.

Investing for Growth

The Power of Compound Interest

Investing allows your money to work for you, helping you grow your wealth over the long term. This chapter introduces you to the concept of compound interest, where your earnings generate additional earnings, creating a snowball effect of growth. Compound interest is a key driver of long-term wealth building, and understanding it is essential for making informed investment decisions.

Types of Investments

The chapter dives into various investment options available, including stocks, bonds, mutual funds, and real estate. Each investment type carries its own level of risk and potential return. The Ramsey Classroom provides an overview of these options, enabling you to make informed choices based on your risk tolerance, time horizon, and financial goals. The goal is to create a diversified portfolio that balances risk and potential reward.

Expert Tips for Success

As a seasoned financial blogger, I’ve learned that the key to successful financial management lies in developing sustainable habits and integrating smart practices into your daily life. Here’s a concise breakdown of key tips:

- Track your spending: This is the foundation of budgeting. Track every dollar you spend, whether it’s a coffee or a new pair of shoes, to gain a clear understanding of your spending patterns.

- Automate your savings: Set up automatic transfers from your checking account to your savings account on a regular basis. This ensures you never forget to save.

- Live below your means: Resist the temptation to keep up with the Joneses. Focus on your financial goals and prioritize your needs over wants.

- Negotiate your debts: Don’t hesitate to reach out to your creditors and negotiate lower interest rates or payment plans.

- Diversify your investments: Spread your money across different asset classes to mitigate risk and potentially maximize returns.

FAQs

Here are some frequently asked questions about Ramsey Classroom Chapter 10 Lesson 2:

- Q: What is the main takeaway from Chapter 10 Lesson 2?

A: Key takeaways include understanding the power of financial literacy, developing a positive money mindset, budgeting effectively, managing debt strategically, and investing for the future.

- Q: How can I make a budget that works for me?

A: Start by tracking your expenses for a month to understand your spending habits. Then categorize your expenses, identify areas where you can cut back, and allocate your income to your financial goals.

- Q: What are some good resources for learning more about personal finance?

A: In addition to the Ramsey Classroom, resources include websites like Investopedia and NerdWallet, books like “The Total Money Makeover” by Dave Ramsey, and financial podcasts like “Planet Money” and “The Tim Ferriss Show.”

Ramsey Classroom Chapter 10 Lesson 2 Activity Answers

Empowering Your Financial Future

Ramsey Classroom Chapter 10, Lesson 2 provides a strong foundation for building financial security. By taking charge of your money, developing smart habits, and seeking knowledge, you can navigate the complexities of personal finance and achieve your financial goals. Remember, financial well-being is not just about money; it’s about peace of mind, freedom to pursue your passions, and the ability to create a brighter future for yourself and your loved ones.

Are you ready to take control of your financial future? Share your thoughts and experiences with Ramsey Classroom in the comments below.