The idea of driving a brand new car without taking on the burden of a traditional loan is tempting, isn’t it? That’s the promise of rent-to-own car contracts. But before you sign on the dotted line, it’s essential to understand the intricacies of these agreements. Just like any major financial decision, navigating the world of rent-to-own car contracts requires careful consideration and a thorough understanding of the terms involved.

Image: www.sampletemplates.com

This guide aims to demystify the world of rent-to-own car contracts, helping you understand exactly what you’re agreeing to and ensuring you make an informed decision that fits your financial situation.

Understanding Rent to Own Car Contracts: A Closer Look

Rent-to-own car contracts, also known as lease-to-own agreements, offer a way to acquire a vehicle over time by making regular payments. This alternative financing method can be a viable option for individuals who may not qualify for traditional auto loans or who prefer a more predictable payment structure. However, it’s important to recognize that these contracts often come with higher overall costs compared to conventional financing.

The process typically involves leasing a vehicle for a predetermined period. During this lease period, the renter makes monthly payments as outlined in the contract. While these payments are usually lower than traditional loan payments, they accrue over time. At the end of the lease, the renter can choose to purchase the vehicle for a pre-agreed price, which is often significantly lower than the original purchase price. This option allows you to build equity in the vehicle over time, making it an attractive option for some.

The Intricacies of Rent to Own Car Contracts

Rent-to-own contracts can be complex, with several factors to consider before signing. Understanding these aspects is vital for making informed decisions and ensuring that the contract aligns with your financial goals and capabilities.

1. Lease Period and Purchase Option

The lease period and purchase option are critical elements of any rent-to-own contract. These aspects determine how long you’ll be paying for the vehicle and the price you’ll pay to acquire ownership. Longer lease periods may offer lower monthly payments, but they also mean you’ll be paying interest for a longer time, potentially increasing the overall cost.

Image: www.sfiveband.com

2. Monthly Payments and Fees

Monthly payments under a rent-to-own contract often include a base rental fee, plus additional charges like insurance, maintenance, and taxes. You’ll also need to factor in potential penalties for early termination of the contract, which can be significant. Be sure to carefully review the contract to understand all associated fees and charges.

3. Purchase Option Price

The price you’ll pay to purchase the vehicle at the end of the lease period is another crucial factor. Ensure you’re comfortable with this price and that it reflects the vehicle’s fair market value. Negotiating this price upfront is often an option, especially if you intend to purchase the vehicle.

4. Vehicle Condition and Maintenance

The condition of the vehicle is vital. Rent-to-own contracts may have specific clauses regarding maintenance and wear and tear. Understanding these clauses and making sure the vehicle is in good condition is essential to avoid additional costs and potential disputes.

5. Early Termination and Penalties

If you decide to terminate the contract before the lease period ends, you may face significant financial penalties. It’s essential to fully understand these penalties and their implications before signing the agreement. These penalties are typically designed to compensate the lessor for any financial loss incurred due to the early termination of the agreement. Be sure to factor in these potential costs for a realistic assessment of your financial obligations.

Navigating Rent-to-Own Contracts: Expert Advice

The decision to enter a rent-to-own contract should be a well-informed one. Here are some critical tips to maximize your chances of a successful and financially sound outcome.

1. Shop Around for the Best Deal

Don’t settle for the first offer you receive. Compare deals from different lenders and compare their contract terms, purchase option prices, and associated fees. This comparative analysis can help you find the best deal that fits your specific financial situation. Online comparison platforms, such as those offered by reputable auto finance companies and independent review sites, can be valuable tools in your search for the best rent-to-own contract. By comparing options, you can identify the most favorable terms and choose the deal that aligns best with your financial goals.

2. Read the Contract Thoroughly

Before signing any contract, read it carefully, ensuring you fully understand each clause. Don’t be afraid to ask questions if anything is unclear, and seek legal advice if needed. Understanding all the terms and conditions is crucial to avoid unexpected costs and issues later on. Take your time, don’t feel pressured, and ensure all your questions are adequately answered before signing.

3. Consider the Long-Term Implications

Rent-to-own contracts can be financially advantageous in the short term due to lower monthly payments. However, consider the long-term costs, including interest, potential penalties, and the overall price you’ll pay for the vehicle. Perform thorough cost analyses for both the rent-to-own option and a traditional auto loan to determine which option is more financially beneficial. Consider the total cost of ownership over the entire lease period, and ensure this cost fits within your budget.

Frequently Asked Questions

Q: Is a rent-to-own car contract a good option for everyone?

A: Rent-to-own car contracts can be beneficial in some situations, but they are not suitable for everyone. It is essential to evaluate your specific financial circumstances, credit score, and overall financial goals before entering such an agreement. Compare the costs of rent-to-own with traditional auto loans to determine the best option for your needs.

Q: How can I find a reputable rent-to-own car provider?

A: Look for companies with a strong reputation and positive customer reviews. You can search online for reviews on websites like the Better Business Bureau, Trustpilot, and consumer complaint forums. Research the companies you are considering, verify their licensing, and choose providers with a proven track record of ethical business practices.

Q: What happens if I can’t make a payment on time?

A: Late payments can lead to penalties, potential repossession of the vehicle, and damage to your credit score. It’s crucial to adhere to the payment schedule outlined in the contract. If you anticipate difficulty making payments, contact the lender promptly to discuss options and avoid negative consequences.

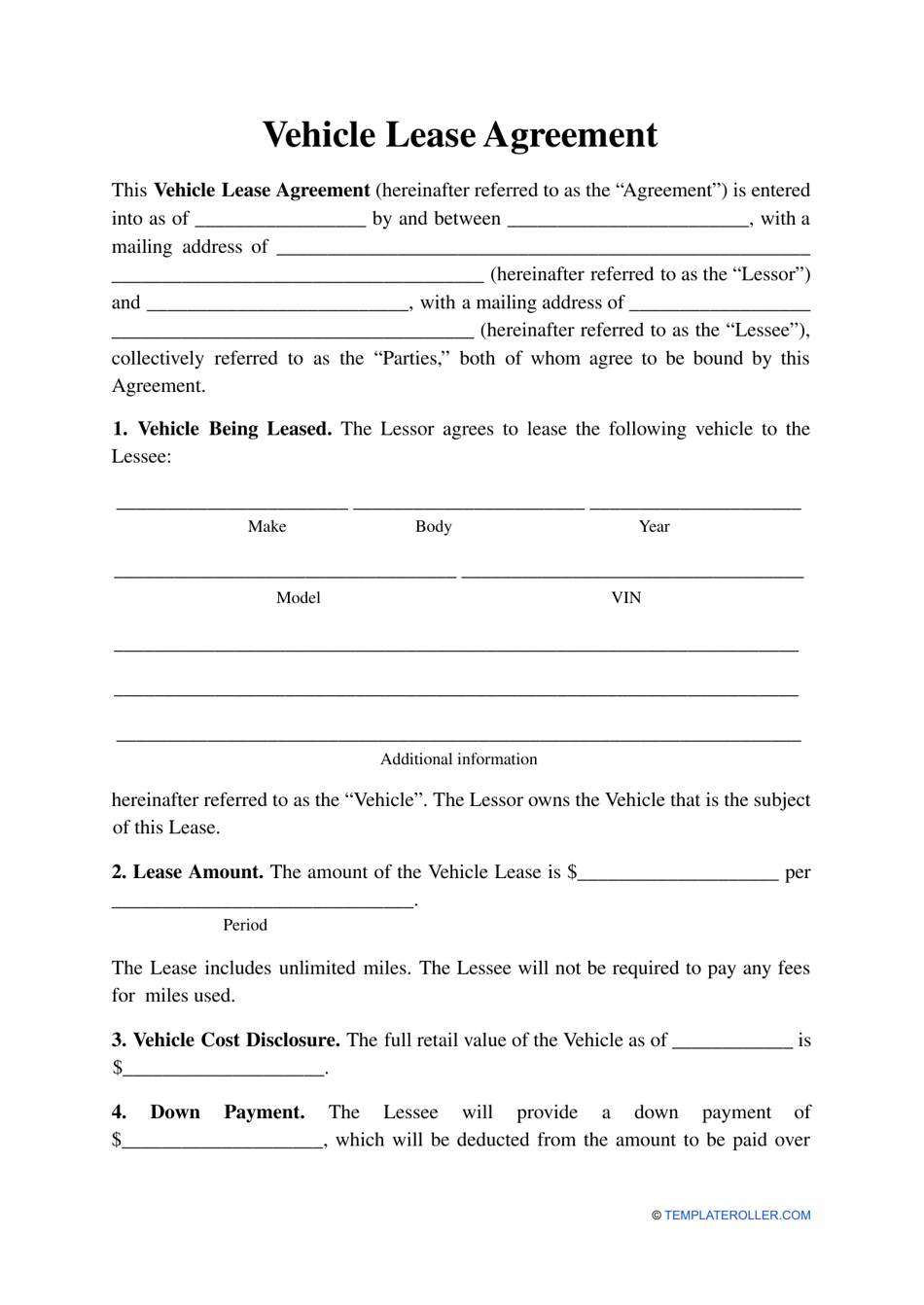

Rent To Own Car Contract Pdf

Conclusion

Rent-to-own car contracts can provide a path to vehicle ownership, but it’s vital to understand the intricacies of these agreements before committing. By carefully evaluating the terms, costs, and potential financial implications, you can make an informed decision that aligns with your financial goals. Remember to shop around, compare deals, and read the contract thoroughly before signing. Understanding the key aspects of rent-to-own contracts is crucial for a successful and cost-effective experience. Are you interested in learning more about this unique financing method and its potential benefits and drawbacks?